IT Global Limited (GLOBAL), a divisional company that prepares its financial statements to 31 December each year,

Question:

IT Global Limited (GLOBAL), a divisional company that prepares its financial statements to 31 December each year, is involved in the assembly of bespoke PC systems for home use (Assembly division), together with the retailing of computer hardware, software and related accessories (Retail division). Due to the deteriorating performance of the Assembly division as a result of strong price competition and changes in customer buying patterns, the directors of GLOBAL decided to significantly change the nature of the company’s business focus.

Consequently, the directors approved the closure of the Assembly division, despite it typically generating approximately 25% of the company’s revenue, Although details of the closure plan were announced publicly on 1 November 2006, including the cessation of advertising and promotion and the notification of suppliers, the Assembly division did not formally close until 31 March 2007.

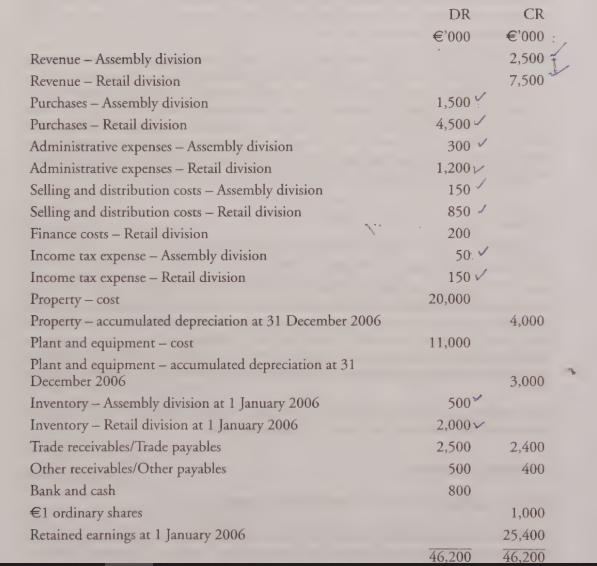

GLOBAL Draft Trial Balance as at 31 December 2006

Additional Information 1. Property, plant and equipment shown in the trial balance above have been depreciated in accordance with company policy and relevant accounting standards in respect of the year ended 31 December 2006, with the depreciation charge being included in the appropriate expense category.

2. Inventory at 31 December 2006 consists of:

Included in the inventory of the Retail division at 31 December 2006 are items that originally cost €240,500. However, the items, which were not insured, were accidentally damaged while being moved in GLOBAL’ warehouse and it will cost €90,000 to repair them. The normal selling price of the items is €375,000. GLOBAL has arranged to sell the items as refurbished goods through an agent once the repair work has been completed at a discount of 25% on the normal selling price. The agent will receive a commission of 12% of the reduced selling price.

3. The directors of GLOBAL would like to make a provision of €2,000,000 at 31 December 2006 for the costs of closing the Assembly division. This amount is net of €1,500,000 for the estimated profit on the disposal of property belonging to the division. During November and December 2006, GLOBAL pursued an active policy to locate a buyer for the property which has a carrying value at 31 December 2006 of €2,500,000 and a fair value of €4,000,000. The contract for the sale of the property was signed on 17 March 2007 and completed on 11 April 2007 for €4,250,000.

4. The plant and equipment shown in the trial balance includes items relating to the Assembly division which are being carried at a value of €1,000,000 at 31 December 2006. The directors anticipate that the plant and equipment will generate cash flows of €700,000 in the three months to 31 March 2007 and that its net selling price at 31 December 2006 was €800,000. The plant and equipment was sold on 31 March 2007 for €600,000.

5. It is anticipated that during the period 1 January 2007 to 31 March 2007 the Assembly division will incur operating losses of €250,000 before it closes. Furthermore, it is estimated that the company will incur retraining costs of €150,000 during this period.

Requirement Prepare the statement of comprehensive income of GLOBAL for the year ended 31 December 2006 and the statement of financial position as at that date.

(Notes to the financial statements are not required, and the tax effects of any adjustments can be ignored.)

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9780903854726

2nd Edition

Authors: Ciaran Connolly