Key figures for Apple and Google follow. Required 1. Compute the debt-to-equity ratios for Apple and Google

Question:

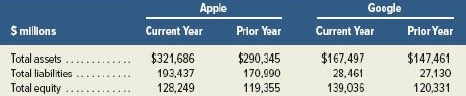

Key figures for Apple and Google follow.

Required

1. Compute the debt-to-equity ratios for Apple and Google for both the current year and the prior year.

2. Use the ratios from part 1 to determine which company?s financing structure is least risky.

3. Is its debt-to-equity ratio more risky or less risky compared to the industry (assumed) average of 0.5 for (a) Apple and (b) Google?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting Information for Decisions

ISBN: 978-1259917042

9th edition

Authors: John J. Wild

Question Posted: