Mark or Make is a bourbon distillery. Sales have been steady for the past three years and

Question:

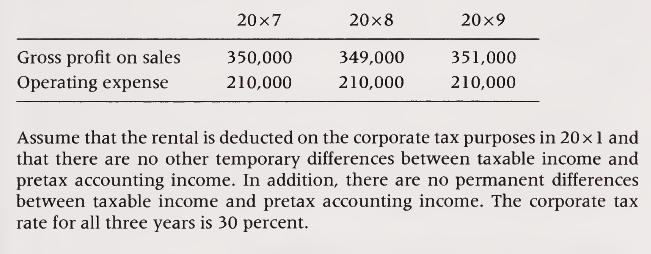

Mark or Make is a bourbon distillery. Sales have been steady for the past three years and operating costs have remained unchanged. On January 1, 20x7, Mark or Make took advantage of a special deal to prepay its rent for three years at a substantial savings. The amount of the prepayment was $60,000. The following income statement items (excluding the rent) are shown below.

Required:

a. Construct income statements for 20x7, 20x8, and 20x9 under the fol¬ lowing approaches to interperiod income tax allocation:

i. No allocation

ii. Comprehensive allocation

b. Do you believe that no allocation distorts Mark or Make's net income? Explain.

c. For years 20x7 and 20x8, Mark or Make reported net income applying the concept of comprehensive interperiod income tax allocation. During 20x8 Congress passed a new tax law that will increase the corporate tax rate from 30 to 33 percent.

Reconstruct the income statements for 20x8 and 20x9 under the following assumptions:

i. Mark or Make uses the deferred method to account for interperiod income tax allocation

ii. Mark or Make uses the asset/liability approach to account for interpe¬ riod income tax allocation

d. Which of the two approaches used in (d) provides measures of income and liabilities that are useful to decision makers? Explain.

Step by Step Answer:

Financial Accounting Theory And Analysis Text And Cases

ISBN: 9780470128817

9th Edition

Authors: Richard G. Schroeder, Myrtle W. Clark, Jack M. Cathey