Question:

Refer to the bond details in Problem 10-4A.

Ellis Company issues 6.5%, five-year bonds dated January 1, 2018, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is 6% on the issue date.

Required

1. Compute the total bond interest expense over the bonds? life.

2. Prepare an effective interest amortization table like the one in Exhibit 10B.2 for the bonds? life.

3. Prepare the journal entries to record the first two interest payments.

4. Use the market rate at issuance to compute the present value of the remaining cash flows for these bonds as of December 31, 2020. Compare your answer with the amount shown on the amortization table as the balance for that date (from part 2) and explain your findings.

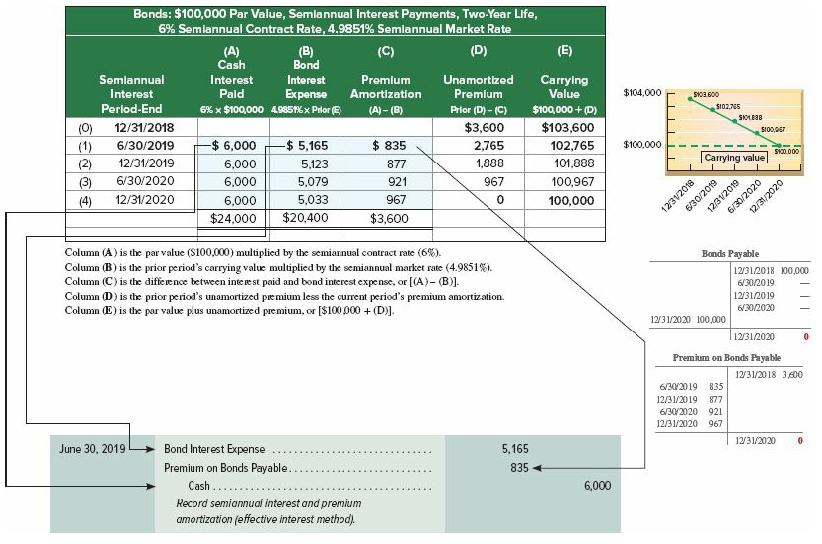

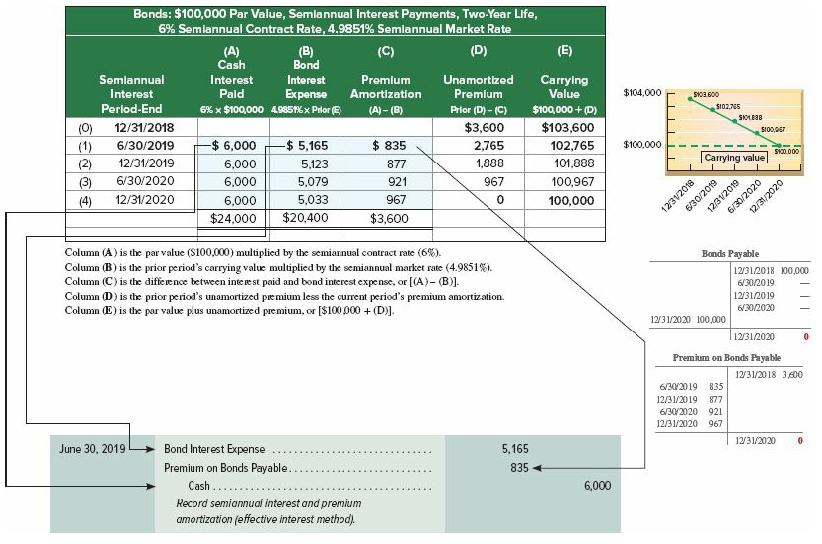

Transcribed Image Text:

Bonds: $100,000 Par Value, Semlannual Interest Payments, Two-Year Life, 6% Semlannual Contract Rate, 4.9851% Semlannual Market Rate (A) Cash (C) (D) (E) (B) Bond Semiannual Interest Pald Interest Premium Unamortized Carrying Value $104,000 Interest Expense 6% x $100,000 4.9851% x Prior (E Amortization Premium 009 EOIS S102,765 Period-End Prior (D) - (C) $100,000 + (D) (A) - (B) SIOLES8 $3,600 $103,600 102,765 (0) (1) (2) 12/31/2018 SIO0,0E7 $ 6,000 $ 835 $100,000 -$ 5,165 6/30/2019 2,765 SI00.000 Carrying value 12/31/2019 1,000 101,888 6,000 5,123 877 6/30/2020 6,000 (3) (4) 5,079 921 967 100,967 12/31/2020 5,033 967 6,000 100,000 630/2019 12/31/2020 $20,400 $24,000 $3,600 Column (A) is the par value (S100,000) multiplied by the semiarnual contract rate (6%). Column (B) is the prior period's carrying value multiplied by the semiannual market rate (4.9851%i. Column (C) is the difference between interest paid and bond interest expense, or [(A)- (B)). Column (D) is the prior period's unamortized premium less the current period's premium amortization. Column (E) is the par value plus unamortized pre mium, or [$100 000 + (D). Bonds Payable 12/31/2018 100,000 6/30/2019 12/31/2019 6/30/2020 12/31/2020 100,000 12/31/2020 Premium on Bonds Payable 12/31/2018 3,600 6/30/2019 835 12/31/2019 877 6/302020 921 12/31/2020 967 12/31/2020 Bond Interest Expense June 30, 2019 5,165 Premium on Bonds Payable. 835 Cash ... 6,000 Record semiannual interest and premium amortization (effective interest method). 123V2018 123V2019 6/30/2020