As mentioned in Theory and Practice 7.3, JDS Uniphase Corporation reported a preliminary loss of $50.558 billion

Question:

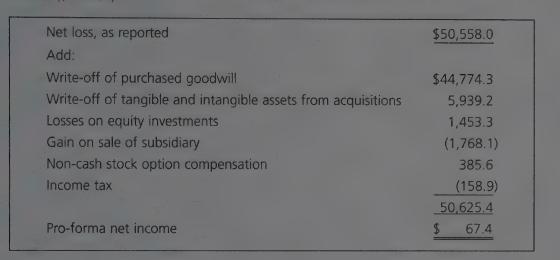

As mentioned in Theory and Practice 7.3, JDS Uniphase Corporation reported a preliminary loss of $50.558 billion for the year ended June 30, 2001. In a July 26, 2001, news release accompanying its financial statements, JDS also presented a “pro-forma” income statement that showed a profit for the year of $67.4 million. The difference is summarized as follows ($ million):

Required

a. The purchased goodwill arose primarily from business acquisitions paid for in shares of JDS Uniphase. In The Globe and Mail, July 27, 2001, Fabrice Taylor stated that in JDS’

case, “most of the goodwill on the books comes from overvalued stock.” In a separate article, Showwei Chu quotes a senior technology analyst as saying, “They paid what the companies were worth at the time.” While currently trading in the $4 range, JDS’ shares were trading between $100 and $200 when most of the acquisitions were made.

i. Assume securities markets are fully efficient. Does the $44,774.3 write-off of purchased goodwill represent a real loss to JDS Uniphase and its shareholders, given that no cash is involved? If so, state precisely the nature of the loss and who ultimately bears it.

ii. Would your answer change if securities markets are subject to momentum and bubble behavior? Explain.

b. What additional information is added to the publicly available information about JDS Uniphase as a result of the supplementary pro-forma income disclosure?

c. Why did JDS Uniphase management present the pro-forma income disclosure?

d. To the extent that investors accept pro-forma income as a measure of management performance, how might this affect management's propensity to overpay for future acquisitions? Explain.

Step by Step Answer: