Brannan own plant and equipment which is used on their construction sites. The depreciation policy of the

Question:

Brannan own plant and equipment which is used on their construction sites. The depreciation policy of the company is to charge a full year’s depreciation in the year of acquisition but none in the year of disposal.

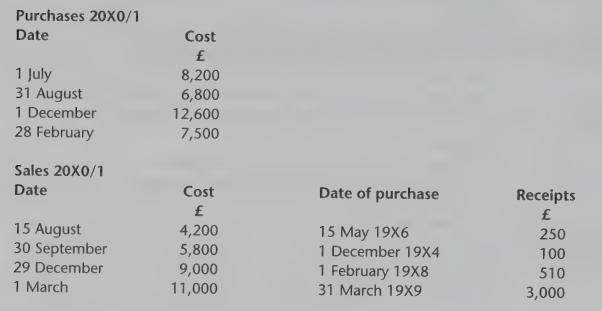

During the year ended 31 March 20X1 the following changes took place:

All the remaining assets had been owned for less than four years. Depreciation is charged on a straight-line basis using a rate of 25 per cent per annum. The balance on the plant and equipment account at 1 April 20X0 was £187,600 and on the provision for depreciation account £62,100.

Required:

Prepare the following accounts:

(a) A plant and equipment account.

(b) A plant and equipment provision for depreciation account.

(c) A disposal account.

Step by Step Answer:

Accounting Theory And Practice

ISBN: 9780273651611

7th Edition

Authors: M. W. E. Glautier, Brian Underdown