Henri owns and operates a small successful sporting goods store. He has not had a holiday for

Question:

Henri owns and operates a small successful sporting goods store. He has not had a holiday

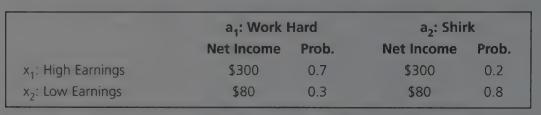

“for three years. He decides to take an extensive one-year trip around the world and is negotiating with Marie to operate the store while he is away. The store’s earnings are highly dependent on how hard the manager works, as per the following table:

Marie, like most people, is risk-averse and effort-averse. Her utility for money is equal to the square root of the amount of money received. If she works hard, her effort disutility is 2.

If she shirks, her effort disutility is1.6.

Marie informs Henri that she is willing to accept the manager position but that she must receive at least an expected utility o3f. 41, or she would be better off to work somewhere else. Henri, who is not an agency theory expert, offers Marie a salary of $20 plus 5% of the store earnings (after deducting $20 salary from the earnings in the table).

Marie immediately accepts.

Required

a. If Henri hires her, which act will Marie take? Why did she immediately accept? Show calculations.

b. Henri’s bank manager, to whom he has turned for advice, suggests that if he hires an agent, the store’s annual earnings should be audited by a professional accountant.

Explain why.

c. Assume that Henri hires Marie under the contract proposed, that is, $20 salary plus 5%

of profits after salary. Shortly after he leaves, a new accounting standard requires that estimated customer liability be accrued. This lowers the high earnings to $286 and the low earnings to $40 in the table above. The payoff probabilities are unaffected. Which act will Marie now take? Show calculations. Will Marie be concerned about the new Standard? Explain why or why not.

Step by Step Answer: