Mr. Smart is an investor with $15,000 to invest. He has narrowed his choice down to two

Question:

Mr. Smart is an investor with $15,000 to invest. He has narrowed his choice down to two possible investments:

• Mutual fund

• Common shares in Buyme Corporation Mr. Smart is risk-averse. The amount of utility he derives from a payoff is:

Utility = 21n(payoff)

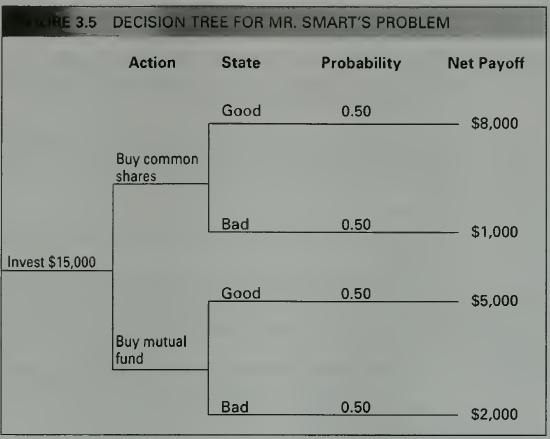

where In denotes natural logarithm. The decision tree for Mr. Smart's problem appears as in Figure 3.5.

Because of a planned major purchase, Mr. Smart intends to sell his investment one year later. The payoffs represent the proceeds from the sale of the investment and receipt of any dividends, net of initial investment. The probabilities represent Mr. Smart's prior probabilities about the state of the economy (good or bad) over the coming year.

Required

a. Calculate Mr. Smart's expected utility for each action and indicate which action he would choose if he acted on the basis of his prior information.

b. Now, suppose Mr. Smart decides that he would like to obtain more informa- tion about the state of the economy rather than simply accepting that it is just as likely to be good as bad. He decides to take a sample of current annual reports of major corporations. Every annual report shows that its firm is doing well, with increased profits over the previous year. The probability that there would be such healthy profits if the state of the economy actually was good is 0.75. The probability of such healthy profits is only 0.10 if the state of the economy actually was bad. Use Bayes' theorem to calculate Mr. Smart's posterior probabilities of the high and low states of the economy. Will he change his decision? Note: Round your calculations to two decimal places.

Step by Step Answer: