Reproduced below is the Economic Value Added (EVA) disclosure from the MD&A section of the 1996 annual

Question:

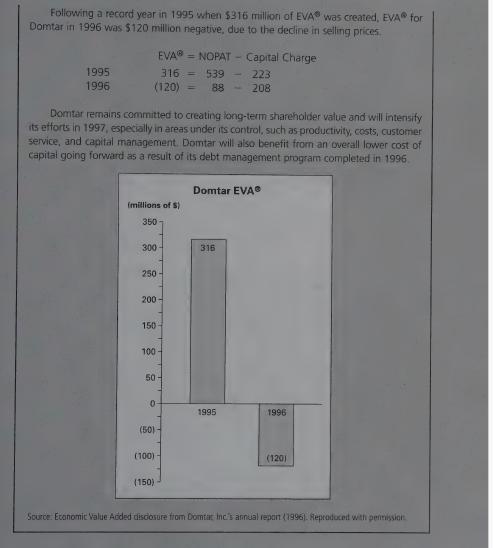

Reproduced below is the Economic Value Added (EVA) disclosure from the MD&A section of the 1996 annual report of Domtar, Inc. Some of the uses of EVA are outlined in Domtar’s discussion in the disclosure. Of interest here is the close relationship between the EVA measurement formula and the clean surplus-based valuation procedure outlined in Example 6.2. Note that the EVA for a given year is equivalent to abnormal earnings (0xta)

for that year in our example. Recall that goodwill is calculated as the present value of expected future abnormal earnings.

It is not clear whether Domtar continues to use EVA, since there is no mention of it in its 2006 annual report. Since 1996 was the last year it gave details of its EVA calculation, we will continue with its 1996 disclosure.

Required :

a. Evaluate the usefulness of this approach to communicating information to investors.

Consider both relevance and reliability issues.

b. If you were the top manager of a company using EVA, would its use encourage or discourage you from initiating major, capital intensive expansion projects? Explain why or why not.

c. You are an investor in a fast-growing, high-tech company that reports EVA. The assets of the company are primarily intangible (patents, skilled workforce) and are unrecorded on the company’s books, hence not included in the EVA capital charge.

How would the unrecorded, intangible nature of the assets of such a company affect your-interpretation of its EVA? Explain.

d. Note that reporting of EVA is voluntary. Domtar reports this information for 1996 even though its EVA is negative. Does Domtar's willingness to report this information add credibility to its claim that it “will intensify its efforts in 1997"? Explain.

Step by Step Answer: