Stephen is a rational, risk-averse investor with $5,000 to invest for one year. He has decided to

Question:

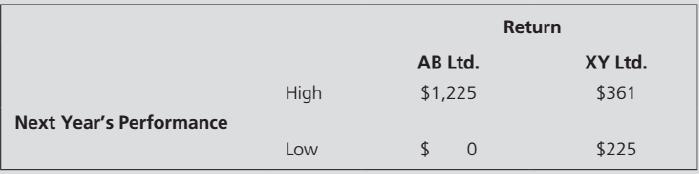

Stephen is a rational, risk-averse investor with $5,000 to invest for one year. He has decided to invest this amount in a high-technology firm and has narrowed his choice down to either AB Ltd. or XY Ltd. AB is a highly speculative firm with good prospects but no established products. XY is a well-established firm with stable performance. The payoffs (net of amount invested) for each firm depend on its next year's performance, as follows:

For each firm, Stephen assesses prior probabilities of 0.5 for each of the high- and low-performance states. His utility for his investment return is equal to the square root of the amount of net payoff received.

Required

a. On the basis of his prior probabilities, should Stephen invest in AB Ltd., (a 1), or XY Ltd. (a 2)? Show calculations.

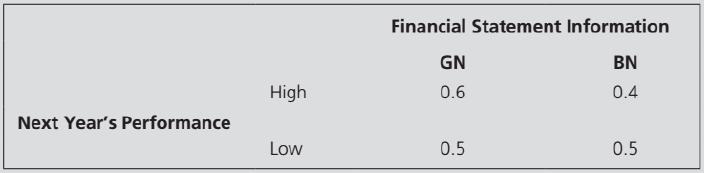

b. XY Ltd. has just released its annual report. Stephen decides to analyze it before investing. His analysis shows "good news" (GN). He consults AI, an expert in financial reporting standards who is quite critical of the quality of current GAAP. AI advises that, based on current GMP, the information system for firms' annual reports is as follows:

The annual report of AB Ltd. is not due for some time, and nothing else has happened to cause Stephen to change his prior probabilities of AB's next year performance. Which investment should Stephen make now? Show calculations.

c . Concerned by several recent financial reporting failures, the accounting standard setters decide to act. They quickly introduce several new accounting standards, including tighter controls over revenue recognition and greater conservatism in asset valuation. Also, the securities commission introduces new corporate governance regulations and restrictions on the ability of auditors to engage in non-audit services for their clients. AI advises Stephen that the information system for annual reports following these new standards and regulations is as follows:

AI advises Stephen to ignore the information system in part b and instead use this one to revise his prior probabilities of XY Ltd.'s next year's performance based on the GN in its annual report. AB Ltd. still has not reported and Stephen's prior probabilities of its performance are unchanged. Which act should Stephen now take? Show calculations.

Step by Step Answer:

Financial Accounting Theory

ISBN: 9780134166681

8th Edition

Authors: William R. Scott, Patricia O'Brien