What is the beta of: a. The market portfolio b. The risk-free asset c. Portfoho A +

Question:

What is the beta of:

a. The market portfolio

b. The risk-free asset

c. Portfoho A + B in Example 3.3 and Section 3.7

Transcribed Image Text:

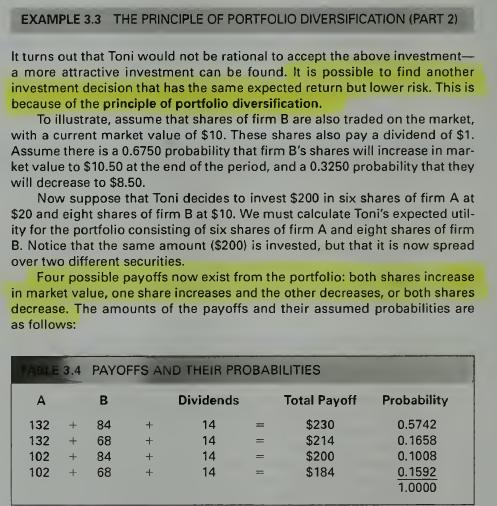

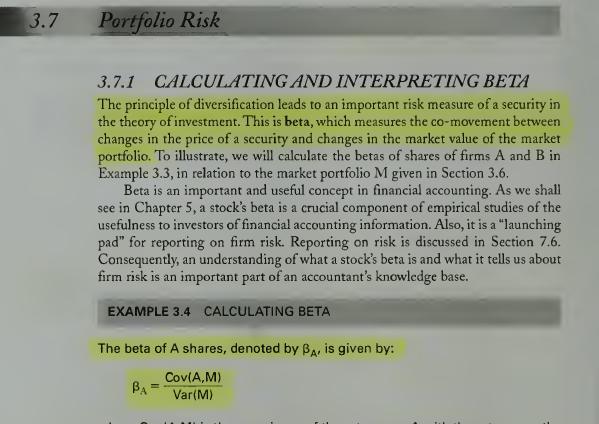

EXAMPLE 3.3 THE PRINCIPLE OF PORTFOLIO DIVERSIFICATION (PART 2) It turns out that Toni would not be rational to accept the above investment- a more attractive investment can be found. It is possible to find another investment decision that has the same expected return but lower risk. This is because of the principle of portfolio diversification. To illustrate, assume that shares of firm B are also traded on the market, with a current market value of $10. These shares also pay a dividend of $1. Assume there is a 0.6750 probability that firm B's shares will increase in mar- ket value to $10.50 at the end of the period, and a 0.3250 probability that they will decrease to $8.50. Now suppose that Toni decides to invest $200 in six shares of firm A at $20 and eight shares of firm B at $10. We must calculate Toni's expected util- ity for the portfolio consisting of six shares of firm A and eight shares of firm B. Notice that the same amount ($200) is invested, but that it is now spread over two different securities. Four possible payoffs now exist from the portfolio: both shares increase in market value, one share increases and the other decreases, or both shares decrease. The amounts of the payoffs and their assumed probabilities are as follows: FABLE 3.4 PAYOFFS AND THEIR PROBABILITIES A B 132 + 132 102 102 ++++ 84 68 84 + 68 ++++ Dividends Total Payoff Probability 14 = $230 0.5742 14 = $214 0.1658 14 $200 0.1008 14 $184 0.1592 1.0000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

Kalyan M. Ranwa

I have more than seven years of teaching experience in physics and mechanical engineering.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

You push horizontally on a block (B) that is on a cart (C). Assume the wheels are good enough that the cart rolls perfectly on the floor. The block does not slip across the cart. How does the...

-

A generator company's common stock has a beta of 1.73. the expected return on the market is 13.45 percent, and the risk free rate on treasury securities is 4.3 percent. A. what is the expected return...

-

1. Security A has expected return of 17.6% and beta of 1.4. If the risk-free rate is 6%, what is the reward-to-risk rate for Security A? Question 2 The common stock of Detroit Engines has a beta of...

-

Identify the five multicultural factors requiring special consideration.

-

a. Consider an L1 cache with an access time of 1 ns and a hit ratio of H = 0.95. Suppose that we can change the cache design (size of cache, cache organization) such that we increase H to 0.97, but...

-

You are engaged in the audit of Phoenix Corp., a new client, at the close of its first fiscal year, April 30, 20X1. The accounts had been closed before the time you began your year-end fieldwork. You...

-

Stock Price The equation used to predict the stock price (in dollars) at the end of the year for McDonald's Corporation is -475.91x1 - 1.99x2 where x is the total revenue (in billions of dollars) and...

-

Why are budgets crucial in accounting for governmental entities? If appropriations were not included in fund accounting, what impact would this exclusion have on the financial statements?

-

Help! And plus show formula on excel to show work on how to do it! Thanks!! Excel Simulation Assignment - Multiple Step Inc... i Saved Help Save & Exlt Submit Preparing a Multi-Step Income Statement...

-

Explain why most of the benefits of diversification can be attained with only a relatively few securities in the portfoho. Assume that an equal amount is invested in each security. Does the riskiness...

-

Refer to Figure 3.4. Suppose Toni's utility function is: Calculate Toni's utility at point Z on Figure 3.4 and compare it with her utility at point M. Which act does Toni prefer? Explain. U;(a)=-160,...

-

Locate and read the article listed below and answer the following questions. Rennie, M. D., L. S. Kopp, and W. M. Lemon. 2010. Exploring Trust and the Auditor-Client Relationship: Factors Influencing...

-

Question 7 Two objects, of masses 3 and 4 kg, are hung from the ends of a stick that is 70 cm long and has marks every 10 cm, as shown above. If the mass of the stick is negligible, at which of the...

-

Since they do not have enough saved, Rachel and John would like to consider retiring later. Create a new timeline and recalculate all of the relevant values to determine at what age Rachel and John...

-

Problem 6 Find the partial derivative with respect to x for the following functions: (a) p = 56 (b) y(x)=56-4x (c) m = r (d) q= x (e) f(x) =x3 (f) g(x,y) = xy 2 (g) h(x,y) = Ax1/2y1/2, where A is a...

-

Consider the information in the file named Cost Functions of the Firm (also presented above). Please read that file carefully before answering this and the following questions. The fixed cost of...

-

On January 1, 2022, Monica Company acquired 80 percent of Young Company's outstanding common stock for $872,000. The fair value of the noncontrolling interest at the acquisition date was $218,000....

-

Briefly discuss the advantages and disadvantages of attached storage, network-attached storage, and storage area networks in meeting enterprise data storage challenges.

-

Decades after the event, Johnson & Johnson (J&J), the 130-year-old American multinational, is still praised for swiftly The company indicated that its response was based on the expectations set forth...

-

En prenant un exemple de votre choix, montrer comment on value un swap de taux de change.

-

How much would you need to invest today in order to receive: a. $10,000 in 5 years at 11%? b. $11,000 in 12 years at 8%? c. $12,000 each year for 10 years at 8%? d. $12,000 at the beginning of each...

-

A company that manufactures pulse Doppler insertion flow meters uses the Straight Line method for book depreciation purposes. Newly acquired equipment has a first cost of $190,000 with a 3-year life...

Study smarter with the SolutionInn App