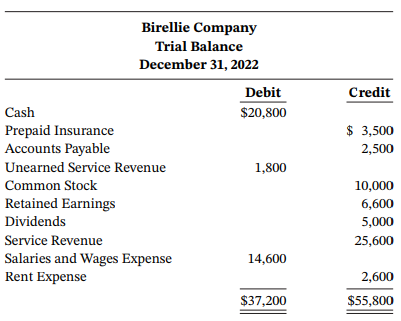

An inexperienced bookkeeper prepared the following trial balance that does not balance. Prepare a correct trial balance,

Question:

An inexperienced bookkeeper prepared the following trial balance that does not balance. Prepare a correct trial balance, assuming all account balances are normal.

Transcribed Image Text:

Birellie Company Trial Balance December 31, 2022 Debit Credit Cash $20,800 $ 3,500 2,500 Prepaid Insurance Accounts Payable Unearned Service Revenue 1,800 Common Stock 10,000 Retained Earnings 6,600 Dividends 5,000 Service Revenue 25,600 Salaries and Wages Expense 14,600 Rent Expense 2,600 $37,200 $55,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (13 reviews)

BIRELLIE COMPANY Trial Balance December 31 2022 Debit Credit Cash Prepaid Insurance Account...View the full answer

Answered By

Susan Juma

I'm available and reachable 24/7. I have high experience in helping students with their assignments, proposals, and dissertations. Most importantly, I'm a professional accountant and I can handle all kinds of accounting and finance problems.

4.40+

15+ Reviews

45+ Question Solved

Related Book For

Financial Accounting Tools for Business Decision Making

ISBN: 978-1119493631

9th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The following accounts are taken from the ledger of Chillin Company at December 31, 2022. Prepare a trial balance in good form. Notes Payable Common Stock Equipment Cash $20,000 25,000 $6,000 5,000...

-

Nona Curry started her own consulting firm, Curry Consulting Inc., on May 1, 2022. The following transactions occurred during the month of May. May 1 Stockholders invested $15,000 cash in the...

-

The unadjusted trial balance of Northern Exposure Inc. had these balances for the following select accounts: Supplies $3,100, Unearned Service Revenue $8,200, and Prepaid Rent $1,200. At the end of...

-

The dimension of a services cape where the background characteristics of the environment that are meant to satisfy our five senses and include things such as temperature, lighting, noise, music, and...

-

A person of mass M stands on a bathroom scale inside a Ferris wheel compartment. The Ferris wheel has radius R and angular velocity . What is the apparent weight of the person (a) At the top (b) At...

-

A spherical communication satellite with a diameter of 2.5 m is orbiting around the earth. The outer surface of the satellite in space has an emissivity of 0.75 and a solar absorptivity of 0.10,...

-

40. Compare the entity-level tax consequences for C corporations, S corporations, and entities taxed as partnerships for both nonliquidating and liquidating distributions of noncash property. Do the...

-

1. Your company supplies ceramic floor tiles to Home Depot, Lowes, and other home improvement stores. You have been asked to start using radio frequency identification tags on each case of tiles you...

-

Arlington Merchants reported the following on its income statement for the fiscal years ended December 31, 2020 and 2019. 2020 2019 Sales $4,853,000 $4,753,000 Cost of goods sold 3,266,069 3,203,522...

-

One of the authors of this book used to be a professional figure skater. For her project when she took introductory statistics (from another author of this book), she was interested in which of two...

-

From the ledger balances below, prepare a trial balance for Peete Company at June 30, 2022. All account balances are normal. Accounts Payable Cash Common Stock Dividends Equipment Service Revenue...

-

Transactions made by Mickelson Co. for the month of March are shown below. Prepare a tabular analysis that shows the effects of these transactions on the expanded accounting equation, similar to that...

-

Discuss the PMs responsibilities toward the project team members. LO9

-

Suppose a company bases its hourly rates on the number of customers per hour. The hourly rate the company charges is given by two functions where = g(2) 4, g(3) = 2, 9(4) = 3 and f(2) = 6, f(3) = 3,...

-

Which statements about insurance are true? 1- Insurance protects against the the worst-case scenario. All rational people want to buy insurance. 2- Insurance costs money, and therefore always...

-

need step by step instruction about creating this: in NX12 PART NAME: BRACKET ALL FILLETS R .313 ALL ROUNDS R .625 2X .500 1/500 2.875 9.500 4750 2875 $500 3.000 750 GENTERED IN OBJECT 2.375

-

8. Convert the angle - 7t from radian measure into degree measure. Show some work. 4

-

4. Variance Analysis. (CPA, adapted) The H. G. Company uses a standard cost system in accounting for the cost of one of its products. < The Budget is based on normal capacity of monthly production of...

-

Financial statements from an end-of-period spreadsheet. Based on the data in Exercise 4-25, prepare an income statement, statement of owners equity, and balance sheet for Alert Security Services Co....

-

DEPARTMENT DATA EMPLOYEE DATA EmployeeNumber FirstName Mary Rosalie Richard George Alan 3 4 5 7 8 9 855555ES 12 13 14 15 16 17 Create the database tables in SQL or ACCESS: 18 19 20 PROJECT DATA Ken...

-

The management of Easterling Corp. is considering the effects of various inventory-costing methods on its financial statements and its income tax expense. Assuming that the price the company pays for...

-

In its first month of operation, Moraine Company purchased 100 units of inventory for $6, then 200 units for $7, and finally 140 units for $8. At the end of the month, 180 units remained. Compute the...

-

For each of the following cases, state whether the statement is true for LIFO or for FIFO. Assume that prices are rising. (a) Results in a higher quality of earnings ratio. (b) Results in higher...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App