Case Corporation, based in Racine, Wisconsin, manufactures farm tractors, farm equipment, and light- and medium-sized construction equipment.

Question:

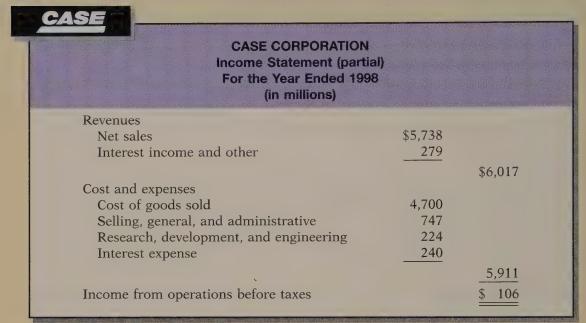

Case Corporation, based in Racine, Wisconsin, manufactures farm tractors, farm equipment, and light- and medium-sized construction equipment. The company’s products are distributed through both independent and company-owned distributing companies, which are located throughout the world. Case Corporation's 1998 partial income statement is shown below.

Assume that this partial income statement was prepared before all adjusting entries had been made, and that the internal audit staff identified the following items that require adjustments:

1. Depreciation on the administrative offices of $13 million needs to be recorded.

2. A physical inventory determined that $1 million in office supplies had been used in 1998.

3. $4 million in salaries have been earned but not recorded. Half of this amount is for the salaries of engineering staff; the other half is for the administrative staff.

4. $3 million in insurance premiums were prepaid on May 1 and expired by year end.

5. $7 million in prepaid rent has expired at year-end.

6. Cost of goods sold of $2 million was recorded in error as interest expense.

Instructions

(a) Make the adjusting entries required. Use standard account titles.

(b) Which of the entries is not a routine adjusting entry? Explain your answer.

(c) For each of the accounts in these adjusting entries that will be posted to Case’s general ledger, tell which item on the income statement will be increased or decreased.

(d) Recast the partial income statement based on the adjusting entries prepared.

A GLOBAL FOCUS

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471347743

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso