In recent years Erie Company has purchased three machines. Because of frequent employee turnover in the accounting

Question:

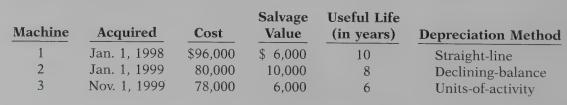

In recent years Erie Company has purchased three machines. Because of frequent employee turnover in the accounting department, a different accountant was in charge of selecting the depreciation method for each machine, and various methods have been used. Information concerning the machines is summarized in the table:

For the declining-balance method, Erie Company uses the double-declining rate. For the units-of-activity method, total machine hours are expected to be 24,000. Actual hours of use in the first 3 years were: 1999, 4,000; 2000, 4,500; and 2001, 5,000.

Instructions

(a) Compute the amount of accumulated depreciation on each machine at December 31, 2001.

(b) If machine 2 was purchased on April 1 instead of January 1, what would be the depreciation expense for this machine in 1999? In 2000?

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471347743

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso