Tammy Company and Hamline Company are two companies that are similar in many respects except that Tammy

Question:

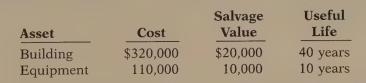

Tammy Company and Hamline Company are two companies that are similar in many respects except that Tammy Company uses the straight-line method and Hamline Company uses the declining-balance method at double the straight-line rate. On January 2, 1999, both companies acquired identical depreciable assets listed in the table below.

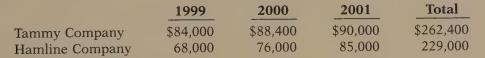

Hamline’s depreciation expense was $38,000 in 1999, $32,800 in 2000, and $28,520 in 2001. Including the appropriate depreciation charges, annual net income for the companies in the years 1999, 2000, and 2001 and total income for the 3 years were as follows:

At December 31, 2001, the balance sheets of the two companies are similar except that Hamline Company has more cash than Tammy Company.

Dawna Tucci is interested in investing in one of the companies, and she comes to you for advice.

Instructions With the class divided into groups, answer the following:

(a) Determine the annual and total depreciation recorded by Tammy during the 3 years.

(b) Assuming that Hamline Company also uses the straight-line method of depreciation instead of the declining-balance method (that is, Hamline’s depreciation expense would equal Tammy’s), prepare comparative income data for the 3 years.

(c) Which company should Dawna Tucci invest in? Why?

COMMUNICATION ACTIVITY

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471347743

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso