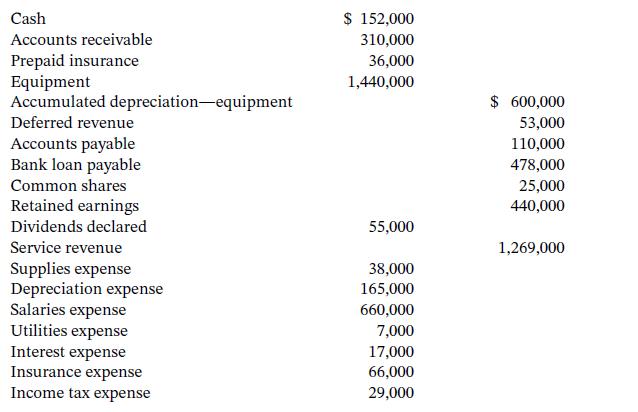

Ltd.s trial balance at September 30, 2021, was as follows: The companys bookkeeper had failed to record

Question:

Ltd.’s trial balance at September 30, 2021, was as follows:

The company’s bookkeeper had failed to record adjusting entries for the following:

1. The company’s employees had earned salaries of $22,100 during the last six working days in September. These will be paid in the first week of October.

2. Interest on the bank loan was not accrued for the month. The loan bears interest at 6%.

3. No depreciation expense was recorded for the equipment for September. The equipment is expected to have an estimated six-year useful life.

4. The company satisfied its performance obligations related to $18,000 of the deferred revenue. Instructions

a. What would Suski’s net income have been without the missing adjustments? What would it have been if the necessary adjusting entries were made?

b. Quantify the amount by which Suski’s working capital would have changed as a result of making the necessary adjusting entries.

c. Determine Suski’s current ratio before and after the necessary adjusting entries were made. Would it have been overstated or understated if the necessary adjusting entries were not made?

d. Were Suski’s total liabilities understated or overstated before the necessary adjusting entries were made? By what amount?

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9781119594574

8th Canadian Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine, Christopher D. Burnley