On January 1, 2025, Tacoma Corporation had these stockholders' equity accounts. During the year, the following transactions

Question:

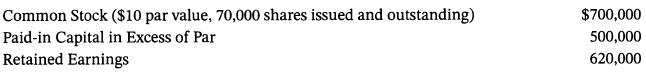

On January 1, 2025, Tacoma Corporation had these stockholders' equity accounts.

During the year, the following transactions occurred.

Jan. 15 Declared a \(\$ 0.50\) cash dividend per share to stockholders of record on January 31, payable February 15.

Feb. 15 Paid the dividend declared in January.

Apr. 15 Declared a 10\% stock dividend to stockholders of record on April 30, distributable

May 15. On April 15, the market price of the stock was \(\$ 14\) per share.

May 15 Issued the shares for the stock dividend.

Dec. 1 Declared a \(\$ 0.60\) per share cash dividend to stockholders of record on December 15 , payable January 10,2026 .

31 Determined that net income for the year was \(\$ 400,000\).

Instructions

a. Journalize the transactions. (Include entries to close net income and dividends to Retained Earnings.)

b. Enter the beginning balances and post the entries to the stockholders' equity T-accounts. (Note: Open additional stockholders' equity accounts as needed.)

c. Prepare the stockholders' equity section of the balance sheet at December 31 .

d. Calculate the payout ratio and return on common stockholders' equity.

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9781119791089

10th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell