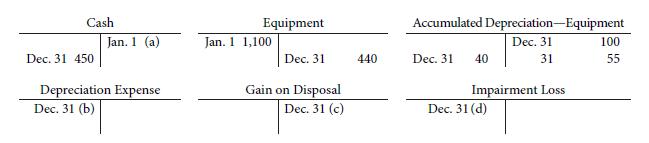

Shown below are the T accounts relating to equipment that was purchased for cash by a company

Question:

Shown below are the T accounts relating to equipment that was purchased for cash by a company on the first day of the current year. The equipment was depreciated on a straight-line basis with an estimated useful life of 10 years and a residual value of $100. Part of the equipment was sold on the last day of the current year for cash proceeds while the remaining equipment that was not sold became impaired.

Instructions

Reconstruct the journal entries to record the following and derive the missing amounts:

(a) Purchase of equipment on January 1. What was the cash paid?

(b) Depreciation recorded on December 31. What was the depreciation expense?

(c) Sale of part of the equipment on December 31. What was the gain on disposal?

(d) Impairment loss on the remaining equipment on December 31. What was the impairment loss?

Step by Step Answer:

Financial Accounting Tools for Business Decision Making

ISBN: 978-1118644942

6th Canadian edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine