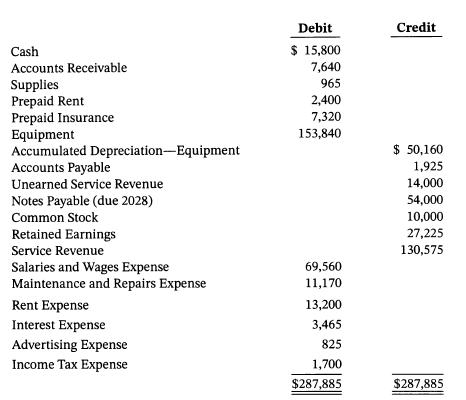

The following is Wolastoq Tours Inc.'s unadjusted trial balance at its year-end, November 30, 2025. The company

Question:

The following is Wolastoq Tours Inc.'s unadjusted trial balance at its year-end, November 30, 2025. The company adjusts its accounts annually.

Additional information:

Additional information:

1. The insurance policy has a 1-year term beginning April 1, 2025. At that time, a premium of \(\$ 7,320\) was paid.

2. The equipment was acquired on December 1,2022 . The equipment is depreciated at an annual rate of \(\$ 25,080\).

3. A physical count shows \(\$ 300\) of supplies on hand at November 30.

4. The note payable has a \(7 \%\) interest rate. Interest is paid on the first day of each following month and was last paid on November 1.

5. Deposits of \(\$ 1,400\) each were received for advance tour reservations from 10 school groups. At November 30, tours have been provided for all of these groups.

6. Employees are owed a total of \(\$ 500\) in salaries and wages at November 30.

7. A senior citizens' organization that had not made an advance deposit took a river tour for \(\$ 1,250\). This group was not billed until December for the services performed.

8. Additional advertising costs of \(\$ 260\) have been incurred, but the bills have not been received by November 30 .

9. On November 1 , the company paid \(\$ 2,400\) rent in advance for November and December.

10. Income taxes payable for the year are estimated to be an additional \(\$ 300\) beyond that recorded to date.

Instructions

a. Prepare the adjusting entries required at November 30 .

b. Set up T-accounts, enter the opening balances, and post the November adjusting entries to the general ledger.

c. Prepare an adjusted trial balance at November 30.

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9781119791089

10th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell