A, B and C were partners sharing profits in the proportion of one-half, one-fourth and one-fourth respectively.

Question:

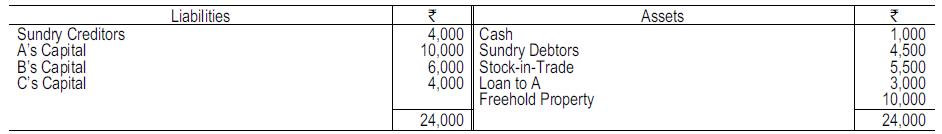

A, B and C were partners sharing profits in the proportion of one-half, one-fourth and one-fourth respectively. Their Balance Sheet on 31st December, 2017 was as follows : A died on 1st January, 2018. The firm had affected an assurance of ₹10,000 on the joint lives of the three partners and the amount on the policy was realised on 1st February, 2018. According to the partnership agreement, the goodwill was to be calculated at two years’ purchase of average profits of three completed years preceding the death or retirement of a partner. The deceased partner’s share of capital and goodwill, etc., was paid out in cash on 1st March, 2018, the available cash balance being supplemented by a loan from the firm’s bankers on the security of the freehold property. The net profits of the years 2015, 2016 and 2017 were ₹5,500, ₹4,800 and ₹6,600 respectively. You are required to show the Ledger Accounts of the partners and the Balance Sheet of B and C as it would stand after A’s share is paid out.

A died on 1st January, 2018. The firm had affected an assurance of ₹10,000 on the joint lives of the three partners and the amount on the policy was realised on 1st February, 2018. According to the partnership agreement, the goodwill was to be calculated at two years’ purchase of average profits of three completed years preceding the death or retirement of a partner. The deceased partner’s share of capital and goodwill, etc., was paid out in cash on 1st March, 2018, the available cash balance being supplemented by a loan from the firm’s bankers on the security of the freehold property. The net profits of the years 2015, 2016 and 2017 were ₹5,500, ₹4,800 and ₹6,600 respectively. You are required to show the Ledger Accounts of the partners and the Balance Sheet of B and C as it would stand after A’s share is paid out.

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee