About the Industry: The compressor and drilling equipment industry is cyclical in nature and its prospects depend

Question:

About the Industry: The compressor and drilling equipment industry is cyclical in nature and its prospects depend on the general economic conditions and fresh investments in user industries. Compressors find applications in industries such as petrochemicals, fertilizers and food processing. Drilling equipment is used in coal mining, rock drilling, road construction, and other infrastructure projects.

There are five players in the sector. Most have a wide product profile. This forces players to maintain a high level of inventories. The level of technology plays a significant role in product design. Hence, product design upgradation and innovation play a critical role in retaining customers. Multinationals dominate the business in India. The Indian subsidiaries thus, have access to technology, product profile and markets of the MNC parent. The export and sale of spares and services contribute significantly to the topline.

About the company: Established in 1972, in collaboration with a US-based Pneumatic Tool Company, Kevat Equipment Ltd. manufactures water-well rigs, blast-hole rigs, and allied products. The company has a tie-up with another US-based company to manufacture and export small pneumatic track drills on a continuous basis. It has also developed a new model of an air-operated pump, which has wider applications and a larger market. Kevat has now ventured into wind and gas based power generation projects.

During 20X2-20X3, the company undertook a restructuring of its operations, so as to have flexibility in meeting the cyclical nature of the business, which was foreseen in the coming years. During 20X3- 20X4, the company’s erstwhile foreign promoters sold their stake to Indian promoters.

The Big Issue in August 20X7: The company’s union leaders and the management were locked in a dead-end over the bonus payment for the financial year 20X6. The workers were becoming restless about not being paid bonus for the past three years and there were high chances of a strike being called by them. On the other hand, the company’s argument was that they did not have enough profits and liquidity to pay any bonus for the year. They were requesting the workers to be patient.

The labour commissioner finally interfered and called a meeting of both the parties. He had in his hands, the last three years balance sheet and profit and loss account along with the relevant notes of the company.

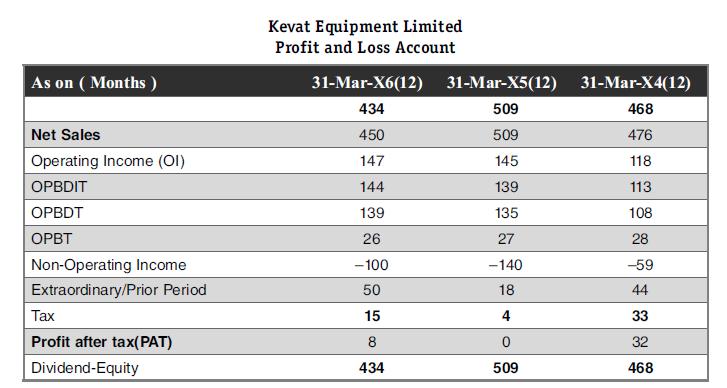

Notes for FY20X6

- Expenditure includes Increase/Decrease in stock in Trade ₹(90) million, Consumption of Raw Material ₹298 million, Staff Cost ₹38 million, and Other expenditure ₹65 million.

- Provision for Taxation includes Current Tax ₹35 million and Deferred Tax ₹15 million.

- The extraordinary item of previous year represents payment of non-competeon-solicitation fee, to Daksh India Ltd.

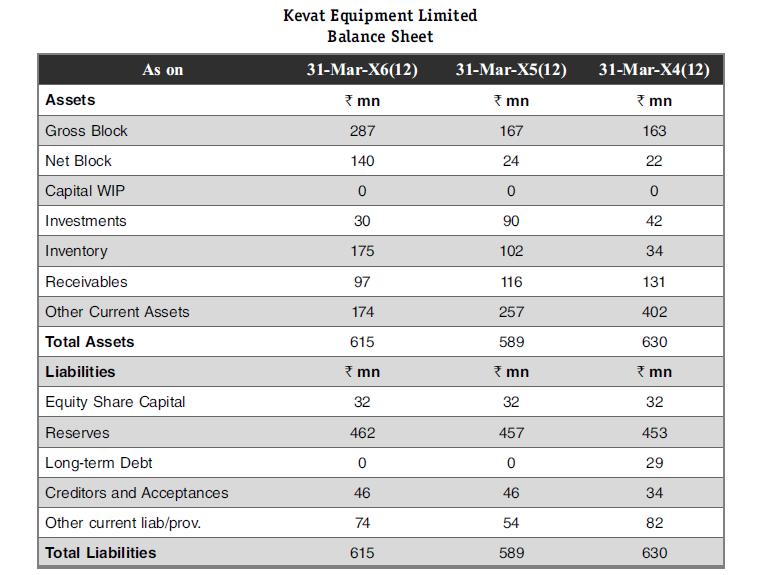

- ₹90 million invested in 12% Non-cumulative Redeemable Preference Shares of Bali Asset Company Pvt Ltd., have been redeemed and proceeds have been received.

- ₹116 million invested in Wind Power Project.

- ₹30 million invested in 12 year 15% Cumulative Participating Preference Shares of Lal Batti Electric Company Ltd.

- Board has recommended ₹2.50 per share as dividend for the year 20X5-X6. Prior year figures have been regrouped to conform with the current year’s presentation, wherever applicable.

- The last installment of non competeon solicitation fee of ₹100 million, has been paid to Daksh India Ltd. to ensure that it, along with companies associated with Daksh AB, Europe, do not compete with Kevat or solicit its key employees for specified periods.

Notes for FY 20X5

- Expenditure includes Increase/Decrease in stock in Trade ₹36 million, Consumption of Raw Material ₹311 million, Staff Cost ₹35 million, and Other expenditure ₹58 million.

- Tax includes Current Tax ₹14 million and Deferred Tax ₹4 million.

- The Company’s operations relate to the manufacture and sale of Drilling Rigs. Accordingly, this being the only primary reportable segment, the Company’s entire sales, profit before tax, asset and liabilities are represented by this segment’s operations.

- The first installment for non competeon solicitation fee of ₹140 millions has been paid to Daksh India Ltd., to ensure that it, along with companies associated with Daksh AB, Europe, do not compete with Kevat or solicit its key employees for specified periods. This expenditure has been incurred for protecting the business interests of the Company and hence, protecting shareholder value. Extra-ordinary item of ₹9 million in year 20X3-X4 refers to VRS Compensation paid.

- No dividend has been declared during the year.

- Prior year figures have been regrouped to conform with the current year’s presentation, wherever applicable.

Notes for FY20X4

- Expenditure includes Increase/Decrease in Stock ₹5 million, Consumption of Raw Materials ₹266 million, Staff Cost `31million, and other expenditure ₹60 million.

- Provision for taxation for year ended March 31, 20X4, includes current tax expenses of ₹62 million and deferred tax credit of ₹8 million.

- Pneumatic Tool Company, USA, holding 40% shares, has entered into an agreement on April 21, 2002.

- The company changed its accounting policy for depreciation from straight line method to written down value method, resulting in a one time depreciation write off to the extent of ₹51 million.

Case Question

1. What do the above financial statements indicate? Is the company’s management correct in saying that they are not having sufficient money to pay bonus? Are the elected union leaders just creating some scenario to ensure enough mileage in the coming elections?

2. Imagine yourself in the place of the labour commissioner – What would be your analysis and hence, the points in favor of the management and the union leaders?

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani