Bailey Delivery Company, Inc., was organized in 2021 in Wisconsin. The following transactions occurred during the year:

Question:

Bailey Delivery Company, Inc., was organized in 2021 in Wisconsin. The following transactions occurred during the year:

a. Received cash from investors in exchange for 10,000 shares of stock (par value of $1.00 per share) with a market value of $4 per share.

b. Purchased land in Wisconsin for $16,000, signing a one-year note (ignore interest).

c. Bought two used delivery trucks for operating purposes at the start of the year at a cost of $10,000 each; paid $4,000 cash and signed a note due in three years for the rest (ignore interest).

d. Paid $1,000 cash to a truck repair shop for a new motor for one of the trucks. (Increase the account you used to record the purchase of the trucks because the productive life of the truck has been improved.)

e. Sold one-fourth of the land for $4,000 to Pablo Development Corporation, which signed a six-month note.

f. Stockholder Helen Bailey paid $27,600 cash for a vacant lot (land) in Canada for her personal use.

Required:

1. Set up appropriate T-accounts with beginning balances of zero for Cash, Short-Term Notes Receivable, Land, Equipment, Short-Term Notes Payable, Long-Term Notes Payable, Common Stock, and Additional Paid-in Capital.

a. Using the T-accounts, record the effects of transactions (a) through (f) by Bailey Delivery Company.

b. Explain your analysis of transaction (f).

2. Prepare a trial balance at December 31, 2021.

3. Prepare a classified balance sheet for Bailey Delivery Company at December 31, 2021.

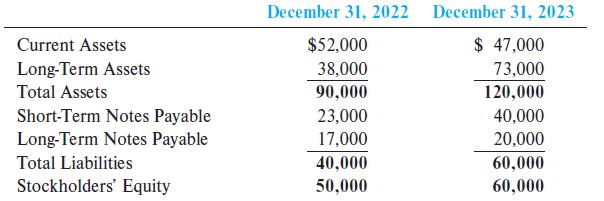

4. At the end of the next two years, Bailey Delivery Company reported the following amounts on its balance sheets:

Compute the company’s current ratio for 2021, 2022, and 2023. What is the trend and what does this suggest about the company?

5. At the beginning of year 2024, Bailey Delivery Company applied to your bank for a $50,000 short-term loan to expand the business. The vice president of the bank asked you to review the information and make a recommendation on lending the funds based solely on the results of the current ratio. What recommendation would you make to the bank’s vice president about lending the money to Bailey Delivery Company?

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge