Best Buy Co., Inc., headquartered in Richfield, Minnesota, is one of the leading consumer electronics retailers, operating

Question:

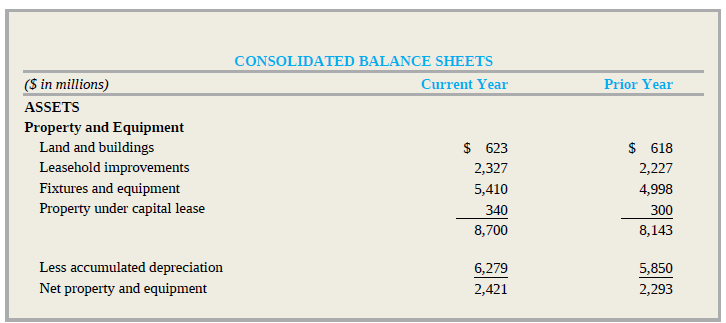

Best Buy Co., Inc., headquartered in Richfield, Minnesota, is one of the leading consumer electronics retailers, operating more than 1,200 stores across the globe. The following was reported in a recent annual report:

Required:

1. Assuming that Best Buy did not sell any property, plant, and equipment in the current year, what was the amount of depreciation expense recorded during the current year?

2. Assume that Best Buy failed to record depreciation during the current year. Indicate the effect of the error (i.e., overstated, understated, or no effect) on the following ratios:

a. Earnings per share.

b. Fixed asset turnover.

c. Current ratio.d. Return on assets.

CONSOLIDATED BALANCE SHEETS ($ in millions) Current Year Prior Year ASSETS Property and Equipment $ 623 $ 618 Land and buildings Leasehold improvements 2,327 2,227 Fixtures and equipment 5,410 4,998 Property under capital lease 340 300 8,700 8,143 Less accumulated depreciation 6,279 5,850 Net property and equipment 2,421 2,293

Step by Step Answer:

Req 1 Depreciation expense of 429 recorded in the current yea...View the full answer

Financial Accounting

ISBN: 978-1259964947

10th edition

Authors: Robert Libby, Patricia Libby, Frank Hodge

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

2.) (3 pts) Consider the following parametric curve: x = 5 cos(3t) Y 5 sin(3t) = where 0 t . Find the arc length of this curve. Show all details of algebra/trig and computation of the integral.

-

The following footnote was abstracted from a recent annual report of Johnson & Johnson Company: Footnote 7: Foreign Currency Translation For translation of its international currencies, the Company...

-

The following information was summarized from a recent annual report of The Hershey Company: (In thousands) Accounts receivable-trade: December 31, 2010...

-

Exercises 11-16: For the measured quantity, state the set of numbers that most appropriately describes it. Choose from the natural numbers, integers, and rational numbers. Explain your answer....

-

Sketch the feasible region of each system of inequalities. Find the coordinates of each vertex. This color-stain painting by American artist Morris Louis (1912-1962) shows overlapping regions similar...

-

A word consists of the bytes b4, b3, b2, and bl. Write a function to invert the bits of b3 and clear the bits of b2, leaving all other bits unchanged.

-

E2-15 Goodwill impairment Pop Corporation recorded goodwill in the amount of $200,000 in its acquisition of Son Company in 2016. Pop paid a total of $700,000 to acquire Son. In preparing its 2017...

-

The SEC Form 10-K on NIKE is reproduced in Appendix C. REQUIRED: Review the NIKE SEC Form 10-K, answer the following question: a. What percentage of total assets do property, plant, and equipment and...

-

Coronado Company began operations on January 1, 2019, adopting the conventional retail inventory system. None of the company's merchandise was marked down in 2019 and, because there was no beginning...

-

Frannie tosses a coin 12 times and gets five heads and seven tails. In how many ways can these tosses result in (a) Two runs of heads and one run of tails; (b) Three runs; (c) Four runs; (d) Five...

-

Shahia Company bought a building for $382,000 cash and the land on which it was located for $107,000 cash. The company paid transfer costs of $9,000 ($3,000 for the building and $6,000 for the land)....

-

The Gap, Inc., is a global specialty retailer of casual wear, accessories, and personal products for women, men, children, and babies under the Gap, Banana Republic, Old Navy, Athleta, and Intermix...

-

Compare and contrast the theories of visual search described in this chapter. Choose one of the theories of attention and explain how the evidence from signal detection, selective attention, or...

-

who do you think sets the underlying ethical standards when the law is fuzzy on an issue? as business and societal issues develop in the future, how does your opinion in this area inform your...

-

how do i introduce low risk high reward for a new medical assistant supervisor role in an organization?

-

How do individual differences in cognitive styles, such as analytical versus intuitive thinking, impact problem-solving approaches and decision-making processes within teams ?

-

In Russian government, do you think that Russian Military Performance is good in warfare against Ukraine? Explain.

-

Why do you think the competing values framework is important to an organization's effectiveness? Describe the four profiles of the competing values framework. Identify one of the profiles and provide...

-

Mahela is a trader. He took goods costing $100 for his own use. How would Mahela record this in his ledger? Account to be debited Account to be credited A drawings inventory drawings purchases C...

-

a. What is meant by the term tax haven? b. What are the desired characteristics for a country if it expects to be used as a tax haven? c. What are the advantages leading an MNE to use a tax haven...

-

GMAC Corporation is planning to issue bonds with a face value of $250,000 and a coupon rate of 6 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31....

-

Last year. Arbor Corporation reported the following: This year, Arbor is considering whether to issue more debt to fund a $100,000 project or to issue additional shares of common stock. Both options...

-

On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization...

-

A contractor constructed a house for resale, which was sold immediately. For tax purposes, this is an example of A) capital income. B) business income. C) other income. D) property income.

-

You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation of 0.15 and a T-bill with a rate of return of 0.05. What percentages of your money must be invested...

-

Nanometrics, Inc., has a beta of 3.43. If the market return is expected to be 13.50 percent and the risk-free rate is 7.00 percent, what is Nanometrics required return? (Round your answer to 2...

Study smarter with the SolutionInn App