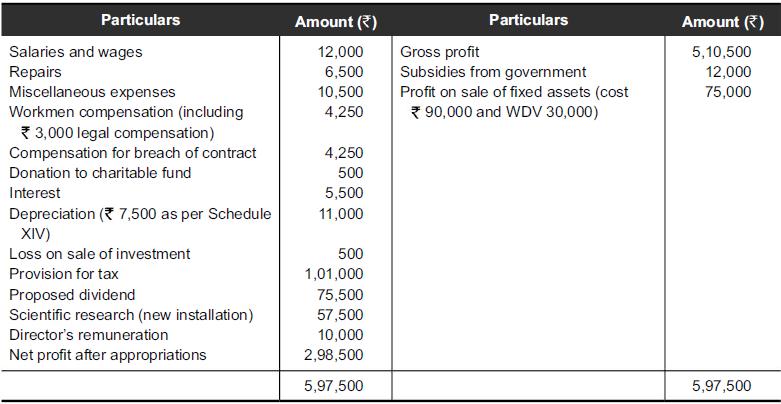

Calculate net profit for managerial remuneration from the following information: Particulars Salaries and wages Repairs Miscellaneous expenses

Question:

Calculate net profit for managerial remuneration from the following information:

Transcribed Image Text:

Particulars Salaries and wages Repairs Miscellaneous expenses Workmen compensation (including 3,000 legal compensation) Compensation for breach of contract Donation to charitable fund Interest Depreciation (7,500 as per Schedule XIV) Loss on sale of investment Provision for tax Proposed dividend Scientific research (new installation) Director's remuneration Net profit after appropriations Amount (2) 12,000 6,500 10,500 4,250 4,250 500 5,500 11,000 500 1,01,000 75,500 57,500 10,000 2,98,500 5,97,500 Particulars Gross profit Subsidies from government Profit on sale of fixed assets (cost *90,000 and WDV 30,000) Amount (*) 5,10,500 12,000 75,000 5,97,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (6 reviews)

Profit f...View the full answer

Answered By

HABIBULLAH HABIBULLAH

I have been tutor on chegg for approx 5 months and had solved a lot of questions.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Calculate net profit for managerial remuneration from the following information: Particulars Salaries and wages Repairs Miscellaneous expenses Workmen compensation (including 1,000 legal...

-

Calculate the managerial remuneration from the following particulars of Zen Ltd. the company has only one Managing Director. Net Profit Net Profit is calculated after considering the following:...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

The $1.6 Billion Mega-millions winning lottery ticket is based upon the total amount of cash received if the annuity option is taken. The cash prize is $913,700,000 which you get immediately. The...

-

The balance sheets of Pin and Sid Corporations, an 80 percent-owned subsidiary of Pin, at December 31, 2011, are as follows (in thousands): The book value of Pin's bonds reflects a $100,000...

-

1. Calculate A assuming an average issue price of $12 per share. 2. Calculate B assuming an average issue price of $60 per share. 3. Calculate C assuming the average issue price was $3.00 per share....

-

Why would the members of a NOT work independently if they were members of a designated team? What does independently mean in this context? LO6

-

Mabel and Alan, who are in the 35% tax bracket, recently acquired a fast-food franchise. Both of them will work in the business and receive a salary of $175,000. They anticipate that the annual...

-

Munoz Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. 10 points Unit-level...

-

Falcon Ltd (FL) provides the following details about its financial results: Equity share capital 70,00,000, Current years profit 40,00,000, Average amount paid as equity dividend in the past three...

-

On April 1, 2008 Gee Pee Ltd (GPL) granted employee stock option plan (ESOP) to its employees for allotting 200 shares to each employee at a price of 40 per share on the vesting date that is after...

-

In Exercises find the general solution of the differential equation. y ln x - xy' = 0

-

n1 = 15, n2 = 18, S = 280, H1: m1 > m2. Exercises 57 present sample sizes and the sum of ranks for the rank-sum test. Compute S, S, and the value of the test statistic z. Then find the P-value.

-

n1 = 25, n2 = 32, S = 850, H1: m1 m2. Exercises 57 present sample sizes and the sum of ranks for the rank-sum test. Compute S, S, and the value of the test statistic z. Then find the P-value.

-

Evaluate the matrix element $\left\langle j_{1} j_{2} J\left|T_{k q}(1) ight| j_{1}^{\prime} j_{2}^{\prime} J^{\prime} ightangle$, where the tensor operator $T_{k q}(1)$ operates only on the part of...

-

Mark Gold opened Gold Roofing Service on April 1. Transactions for April are as follows: 1 Gold contributed \(\$ 15,000\) of his personal funds in exchange for common stock to begin the business. 2...

-

n1 = 20, n2 = 30, S = 400, H1: m1 < m2. Exercises 57 present sample sizes and the sum of ranks for the rank-sum test. Compute S, S, and the value of the test statistic z. Then find the P-value.

-

What are the four bases for determining employee gross earnings?

-

One Way Cellular accountants have assembled the following data for the year ended September 30, 2014: Prepare the operating activities section using the indirect method for One Way Cellulars...

-

Berry Corporation issued a $50,000, 10%, 10-year installment note payable on January 1, 2012. Payments of $8,137 are made each January 1, beginning January 1, 2013. Instructions (a) What amounts...

-

On January 1, 2012, the ledger of Kindt Company contained these liability accounts. Accounts Payable .........$42,500 Sales Taxes Payable .........6,600 Unearned Service Revenue .....19,000 During...

-

Connor Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2012, Connor had the following transactions related to...

-

Assignment Title: The Role of Bookkeeping in Business Management and Financial Reporting Objective: Understand the importance of proper bookkeeping procedures in the management of...

-

17) The adjustment that is made to allocate the cost of a building over its expected life is called:A) depreciation expense.B) residual value.C) accumulated depreciation.D) None of the above answers...

-

9) Prepaid Rent is considered to be a(n):A) liability.B) asset.C) contra-asset.D) expense.10) As Prepaid Rent is used, it becomes a(n):A) liability.B) expense. C) contra-asset.D) contra-revenue.11)...

Study smarter with the SolutionInn App