Classify the following items into asset, expense, liability and income: S. No. 1 2345678 2 9 10

Question:

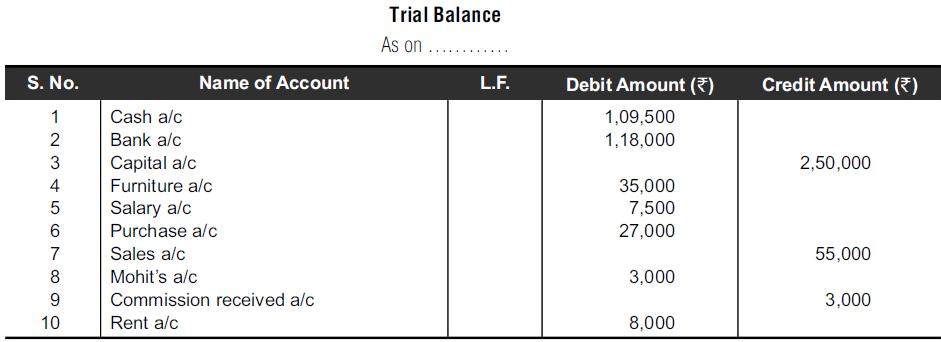

Classify the following items into asset, expense, liability and income:

Transcribed Image Text:

S. No. 1 2345678 2 9 10 Name of Account Cash a/c Bank a/c Capital a/c Furniture a/c Salary a/c Purchase a/c Sales a/c Mohit's a/c Commission received a/c Rent a/c Trial Balance As on. ****** L.F. Debit Amount (*) 1,09,500 1,18,000 35,000 7,500 27,000 3,000 8,000 Credit Amount (*) 2,50,000 55,000 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Detailed answer to ...View the full answer

Answered By

Rajdeep Puri

I learn pedagogy and so I love teaching, being a professional I love it so much because I believe that teaching is a two way process... the student learn from me and I can learn form them.

I HAVE DONE BACHELORS IN SOCIOLOGY AND DIPLOMA IN ELEMENTARY EDUCATION.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Classify the following items into the cost of sales, distribution costs, administrative expenses, other operating income or items to be disclosed after trading profit: (a) Personnel department costs...

-

Determine which of the following numbers could not be probabilities, and why? Select all that apply. A. The number - 175% could not be a probability because it is negative. B. The number 5.87 could...

-

Classify the following items as (a) Deferred expense (prepaid expense), (b) Deferred revenue (unearned revenue), (c) Accrued expense (accrued liability), or (d) Accrued revenue (accrued asset). 1....

-

A torsion pendulum consists of a metal disk with a wire running through its center and soldered in place. The wire is mounted vertically on clamps and pulled taut. Figure a gives the magnitude ? of...

-

Explain the sequence of workpaper adjustments and eliminations for unrealized gains and losses on depreciable plant assets. Is your answer affected by whether the intercompany transaction occurred in...

-

Use nested loops that display the following patterns in four separate programs: Pattern B 12 3 4 5 6 2 3 4 5 123 4 Pattern D 1 2 3 4 5 6 12 3 4 5 123 4 Pattern A Pattern C 2 1 3 2 1 4 3 2 1 5 4 3 2 1...

-

Personality traits and job performance. When attempting to predict job performance using personality traits, researchers typically assume that the relationship is linear. A study published in the...

-

Given the following business scenario, create a Crows Foot ERD using a specialization hierarchy if appropriate. Granite Sales Company keeps information on employees and the departments that they work...

-

a. Jan 1" BOOTSY Company purchases $3,050 worth of merchandise from SALTY Company, terms: 2/10, net 30. b. Jan 3 BOOTSY Company returns $450 of the goods, as they were defective. c. Jan 10th BOOTSY...

-

Capital of a company on April 1, 2010 comprised 2,50,00,000 equity shares of face value 10 each, and 12% preference shares of total value 10,00,00,000. On this date, the net balance of reserve and...

-

Using the following data, prepare financial statementstrading account, profit and loss account and balance sheet: Account Opening stock Purchase Wages Power Salary Advertising Expenses Building...

-

Monthly payments on a $150,000 mortgage are based on an interest rate of 4.9% compounded semiannually and a 30-year amortization. If a $5000 prepayment is made along with the 32nd payment, a. How...

-

The following information appears in the records of Poco Corporation at year-end: a. Calculate the amount of retained earnings at year-end. b. If the amount of the retained earnings at the beginning...

-

For the following four unrelated situations, A through D, calculate the unknown amounts appearing in each column: A B D Beginning Assets... $38,000 $22,000 $38,000 ? Liabilities.. 22,000 15,000...

-

On December 31, John Bush completed his first year as a financial planner. The following data are available from his accounting records: a. Compute John's net income for the year just ended using the...

-

Statement of Stockholders' Equity and Balance Sheet The following is balance sheet information for Flush Janitorial Service, Inc., at the end of 2019 and 2018: Required a. Prepare a balance sheet as...

-

Petty Corporation started business on January 1, 2019. The following information was compiled by Petty's accountant on December 31, 2019: Required a. You have been asked to assist the accountant for...

-

What major safeguards should be built into a system of internal control for purchases of goods?

-

The packaging division of a company having considered several alternative package designs for the company's new product has finally brought down their choices to two designs of which only one has to...

-

Marriott Corporation split into two companies: Host Marriott Corporation and Marriott International. Host Marriott retained ownership of the corporation's vast hotel and other properties, while...

-

Marriott Corporation split into two companies: Host Marriott Corporation and Marriott International. Host Marriott retained ownership of the corporation's vast hotel and other properties, while...

-

During a recent period, the fast-food chain Wendy's International purchased many treasury shares. This caused the number of shares outstanding to fall from 124 million to 105 million. The following...

-

Minden Company introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest that the company can increase sales by 5,000 units for each $2...

-

Prepare the adjusting journal entries and Post the adjusting journal entries to the T-accounts and adjust the trial balance. Dresser paid the interest due on the Bonds Payable on January 1. Dresser...

-

Venneman Company produces a product that requires 7 standard pounds per unit. The standard price is $11.50 per pound. If 3,900 units required 28,400 pounds, which were purchased at $10.92 per pound,...

Study smarter with the SolutionInn App