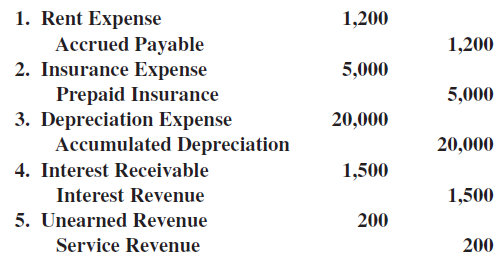

Eaton Enterprises made the following adjusting journal entries on December 31, 2017: a. Give a brief explanation

Question:

a. Give a brief explanation for each of the above entries.

b. Classify each of the above entries as either a cost expiration adjusting entry or an accrual adjusting entry.

1. Rent Expense 1,200 Accrued Payable 2. Insurance Expense Prepaid Insurance 3. Depreciation Expense Accumulated Depreciation 1,200 5,000 5,000 20,000 20,000 4. Interest Receivable 1,500 Interest Revenue 1,500 5. Unearned Revenue 200 Service Revenue 200

Step by Step Answer:

a 1 The entry is to record rent incurred but not yet ...View the full answer

Related Video

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It can be thought of as a \"prepayment\" for goods or services that a person or company is expected to supply to the purchaser at a later date. As a result of this prepayment, the seller has a liability equal to the revenue earned until the good or service is delivered. This liability is noted under current liabilities, as it is expected to be settled within a year.

Students also viewed these Business questions

-

Beta Alloys made the following adjusting journal entries on December 31, 2011. Required:Classify each adjusting entry as either an accrual adjustment (A) or a cost expiration adjusting (C), and...

-

Beta Alloys made the following adjusting journal entries on December 31, 2014. REQUIRED: Classify each adjusting entry as either an accrual adjustment (A) or a cost expiration adjustment (C), and...

-

Sound Company made the following adjusting journal entries at December 31, 2015: Instructions Journalize the reversing entries required. a. Depreciation Expense 2,100 Accumulated Depreciation-...

-

Determine whether the following code fragment takes linear time, quadratic time, or cubic time (as a function of \(n\) ). for (int i = 0; i < n; i++) for (int j = 0; j < n; j++) j) C[i][j] 1.0; if (i...

-

The bartender at your favorite pub sneers that, by using transfer pricing, a company can always eliminate its excess foreign tax credits. Do you agree, or do you think that your friend is forgetting...

-

Show that in Example 2 the y-axis is mapped onto the unit circle in the w-plane.

-

DE 19-14 You are a new accounting intern at Mountain Gear, Inc. Your boss gives you the following information and asks you to compute direct materials used. Purchases of direct materials...

-

On January 1, 2014, Palmer Company acquired a 90% interest in Stevens Company at a cost of $1,000,000. At the purchase date, Stevens Company's stockholders' equity consisted of the following: Common...

-

14 Singh and Danzin is an architectural firm that provides services for residential construction projects. The following overhead cost data are from the current period. -5 Activity client...

-

A marketing firm is planning to conduct a survey of a segment of the potential product audience for one of its customers. The planning process for preparing to conduct the survey consists of six...

-

When Volkswagen AG admitted in fall 2015 that it deceived regulators by rigging exhaust emission results, the company booked a 6.7 billion euro accrual to cover future cash payments related to the...

-

Fall 2015 saw two extremely large business acquisitions. Computer-maker Dell, Inc., agreed to purchase technology storage company EMC Corporation for $67 billion, and soon afterward Anheuser-Busch...

-

In Exercises determine the convergence or divergence of the series. 18 n= n 3

-

A baseball player's slugging percentage SLG can be calculated with the following formula (which is an example of a rational function): SLG = H+2B+2x(3B)+3x(HR) AB Q Image transcription text H+2B+2x...

-

Question During 2021, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a cash-basis consulting practice that had the following income and...

-

Shelly Beaman (social security number 412-34-5670) Is single and resides at 540 Front Street, Ashland, NC 27898. Shelly's W-2 wages Federal withholding Social security wages Social security...

-

P14-26. Forecasting with Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Cisco Systems. CISCO SYSTEMS Consolidated...

-

A little lesson on horseracing.An exacta wager is where you pick the horse that you think will come first, and another who will come second. A trifecta wager is where you pick 3 horses that you think...

-

Reconsider Problem 3.17. a. Apply multiple linear regression to determine the prediction equation for the number of late payments as a function of the annual income and credit score. b. Use the...

-

Smiths Family Fashions implemented a balanced scorecard performance measurement system several years ago. Smiths is a locally owned clothing retailer with fashions for men, women, teens, and...

-

The following balance sheet and income statement data were taken from the records of Harbaugh Auto Supply for the year ended December 31, 2012: The company sells goods and provides services. All...

-

The following balance sheet and income statement data were taken from the records of Standard Center Manufacturing for the year ended December 31, 2012. The company sells goods and provides services....

-

The information below was taken from the IFRS-based 2008 financial statements published by Carrefour, a French retailer (in million euros). Income before tax ... 2,214 Tax . 624 Provision for...

-

Mass LLp developed software that helps farmers to plow their fiels in a mannyue sthat precvents erosion and maimizes the effoctiveness of irrigation. Suny dale paid a licesnsing fee of $23000 for a...

-

Average Rate of Return The following data are accumulated by Lone Peak Inc. in evaluating two competing capital investment proposals: 3D Printer Truck Amount of investment $40,000 $50,000 Useful life...

-

4. (10 points) Valuation using Income Approach An appraiser appraises a food court and lounge and provides the following assessment: o O The building consists of 2 floors with the following (6)...

Study smarter with the SolutionInn App