Ehrlich Co. began business on January 2. Salaries were paid to employees on the last day of

Question:

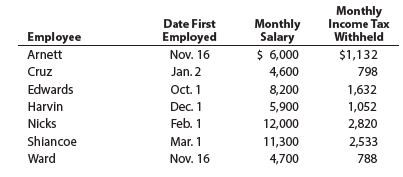

None of the employees resigned or were discharged during the year, and there were no changes in salary rates. The social security tax was withheld at the rate of 6.0% and Medicare tax at the rate of 1.5% on salary. Data on dates of employment, salary rates, and employees€™ income taxes withheld, which are summarized as follows, were obtained from personnel records and payroll records:

Instructions

1. Compute the amounts to be reported for the year on each employee€™s Wage and Tax Statement (Form W-2), arranging the data as follows. Round all amounts to the nearest cent.

2. Compute the following employer payroll taxes for the year:

(a) Social security,

(b) Medicare,

(c) State unemployment compensation at 5.4% on the first $10,000 of each employee€™s earnings,

(d) Federal unemployment compensation at 0.8% on the first $10,000 of each employee€™s earnings, and

(e) Total. Round all amounts to the nearest cent.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Corporate Financial Accounting

ISBN: 9781337398169

15th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac