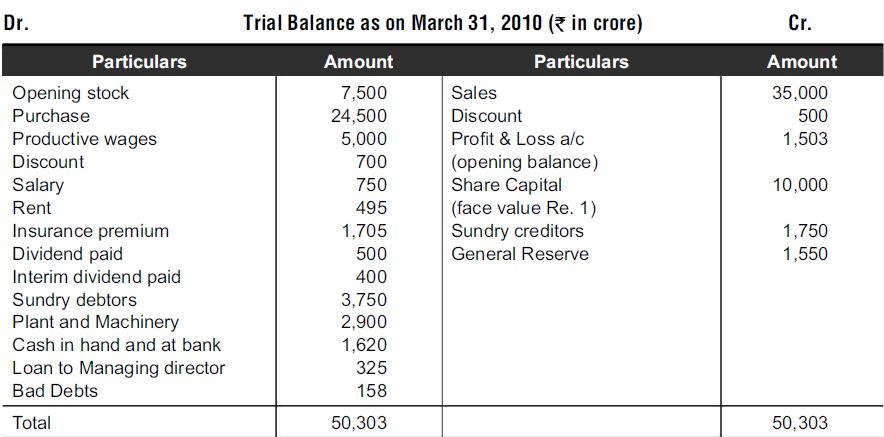

From the following trial balance, prepare trading account, profit and loss account and balance sheet. Additional Information

Question:

From the following trial balance, prepare trading account, profit and loss account and balance sheet.

Additional Information (adjustments)

(i) Closing stock was ₹8,200 crore

(ii) Insurance premium for 6 months at the rate of ₹50 crore per annum was pre-paid.

(iii) one month rent ₹35 crore was due but not paid.

(iv) Provide depreciation on plant and machinery @ 10%.

(v) Make provision for doubtful debts @ 5% and provision for discount on debtors @ 2%

(vi) Goods costing ₹1,000 crore were dispatched on March 28, 2010 but a bill for the amount for ₹1,250 crore was raised only on April 2, 2010. One more credit sales transaction of ₹250 was completed in March, 2010 but not recorded in the books of accounts.

(vii) Bank statement revealed that bank had debited us for bank charges of ₹1 crore and for interest ₹2 crore but not recorded in cash book.

(viii) A cheque of ₹3 crore deposited by us was dishonoured, entered in pass book but not in cash book; it was disclosed that party had been declared insolvent and nothing is recoverable.

(ix) Cheques of ₹5 crore issued but not presented for payment till March 31, 2010.

(x) Goods costing ₹200 crore were destroyed by fire and insurance company admitted the claim for ₹175 crore only.

(xi) In case of sufficient net profit transfer ₹2,000 crore to general reserve.

(xii) Remaining profit, if any is to be kept as surplus.

Step by Step Answer: