Gibbs Ltd operates a manufacturing facility to produce its key products. On 1 July 2019, the balance

Question:

Gibbs Ltd operates a manufacturing facility to produce its key products. On 1 July 2019, the balance of an equipment account was as follows:

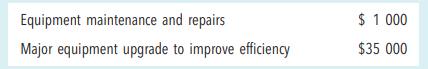

During the 2020 financial year, Gibbs Ltd made the following expenditures:

The equipment has an expected useful life of 20 years, and residual value is $7200. Gibbs Ltd depreciates equipment on a straight-line basis.

1. What is the journal entry that was made on 30 June 2018 for depreciation on manufacturing equipment?

2. Indicate the effects of the two expenditures during 2020 on assets, liabilities and shareholders’ equity.

3. Give the journal entries to record the two expenditures during the 2020 financial year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Integrated Approach

ISBN: 9780170411028

7th Edition

Authors: Ken Trotman, Elizabeth Carson

Question Posted: