Hari Limited (HL) acquired 90% shares of Shyam Limited (SL) on April 1, 2010 and the balance

Question:

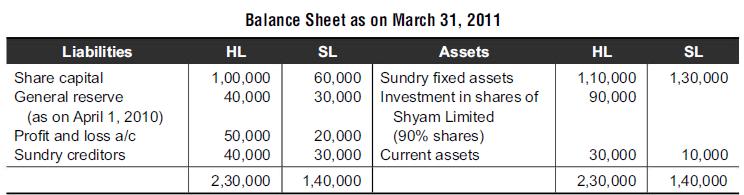

Hari Limited (HL) acquired 90% shares of Shyam Limited (SL) on April 1, 2010 and the balance sheet of both the companies as on March 31, 2011 is as follows:

The profit and loss account of Shyam Limited has a credit balance of ₹6,000 on April 1, 2010. The fair value of sundry fixed assets on the date of acquisition is ₹1,00,000. Prepare consolidated financial statement as on March 31, 2011.

Transcribed Image Text:

Liabilities Share capital General reserve (as on April 1, 2010) Profit and loss a/c Sundry creditors Balance Sheet as on March 31, 2011 SL Assets 60,000 Sundry fixed assets 30,000 Investment in shares of HL 1,00,000 40,000 50,000 40,000 2,30,000 Shyam Limited (90% shares) 20,000 30,000 Current assets 1,40,000 HL 1,10,000 90,000 30,000 2,30,000 SL 1,30,000 10,000 1,40,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Consolidated Balance Sheet of Hari Limited and its Subsidiary Shyam Limited As on March 31 2011 Liab...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Hari Limited acquired all the shares of Shyam Limited on April 1, 2010 and the balance sheet of both the companies as on March 31, 2011 is as follows: The profit and loss account of Shyam Limited has...

-

Hari Limited acquired all the shares of Shyam Limited on April 1, 2010 and the balance sheet of both the companies as on March 31, 2011 is as follows: The profit and loss account of Shyam Limited has...

-

I had ask for need to build a comparison of legal laws that regulate employment differences and similarities, global principlesComparision between Germany, China, and the United States. the answer I...

-

The following are the Year 9 income statements of Kent Corp. and Laurier Ltd. Additional Information ¢ Kent acquired its 40% interest in the common shares of Laurier in Year 3 at a cost of...

-

Ashton Mills. President of Smart Calc Inc., was reviewing the product profitability reports with the controller, Andrew Scott. The following conversation took place. Ashton: Ive been reviewing the...

-

Consider Joey and Phoebe, our mac and cheese lovers from Problem 10. Comment on the following statement: Because Joey really loves cheese, when he maximizes his utility, he will be willing to give up...

-

Why is it important to evaluate your change management experiences and document them as lessons learned? AppendixLO1

-

What is the present worth of a series of equal quarterly payments of $3000 that extends over a period of 8 years if the interest rate is 10% compounded monthly?

-

Isn't Rachel qualified if she receive form 2120 "multiple support declaration" from Camille? Rachel is his daughter, gross income is under 4,300 and she is contributing more than 10 percent of the...

-

Jindal Aluminum Limited (JAL) acquired a machinery from Jagson Enterprises (JE) for a lease term of four years, which covers almost complete economic life of the asset. The lease commences on April...

-

From the following balance sheet, prepare consolidated balance sheet of Ram Limited (RL) that has one subsidiary namely Mohan Limited (ML). ML had a credit balance of 45,000 in its profit and loss...

-

Identify four constraints on team decision making and describe four structures that support idea generation in teams. AppendixLO1

-

POTI ENTERPRISES LTD. STATEMENT OF INCOME FOR THE YEAR ENDED DECEMBER 31 (current year) SALES $600,000 COST OF SALES: $50,000 OPENING INVENTORY 250,000 PURCHASES 300,000 CLOSING INVENTORY 60,000...

-

10. Describe a qualified defined contribution plan for the self-employed and discuss the advantages and disadvantages in adopting this type of plan. 11. Describe a SEP IRA and discuss the advantages...

-

7.) In 1999, the average percentage of women who received prenatal care per country is 80.1%. Table #7.3.9 contains the percentage of woman receiving prenatal care in 2009 for a sample of countries...

-

Describe A demographic profile of the population and community that will be served through the reinvented Human Service program. The description must include all eligibility requirements (i.e.,...

-

You work for a major financial institution. Your branch handles customer calls from a wide variety of individuals. Recently, you've noticed an increase in calls from individuals from African...

-

Explain how the interest rate works in the classical system to stabilize aggregate demand in the face of autonomous changes in components of aggregate demand such as investment or government spending.

-

Critical reading SAT scores are distributed as N(500, 100). a. Find the SAT score at the 75th percentile. b. Find the SAT score at the 25th percentile. c. Find the interquartile range for SAT scores....

-

Presented here is basic financial information (in millions) from the 2009 annual reports of Nike and Adidas. InstructionsCalculate the receivables turnover ratio and average collection period for...

-

The following represents selected information taken from a company's aging schedule to estimate uncollectible accounts receivable at year-end. Instructions(a) Calculate the total estimated bad debts...

-

At December 31, 2011, Littman Company reported this information on its balance sheet. Accounts receivable $960,000 Less: Allowance for doubtful accounts 78,000 During 2012, the company had the...

-

Which of the following statements is not true regarding the $500 credit for dependent other than a qualifying child credit. Cannot be claimed on the same tax return if the child tax credit is also...

-

Grind Co. is considering replacing an existing machine. The new machine is expected to reduce labor costs by $127,000 per year for 5 years. Depreciation on the new machine is $57,000 compared with...

-

If John invested $20,000 in a stock paying annual qualifying dividends equal to 4% of his investment, what would the value of his investment be 5 years from now? Assume Johns marginal ordinary tax...

Study smarter with the SolutionInn App