Question:

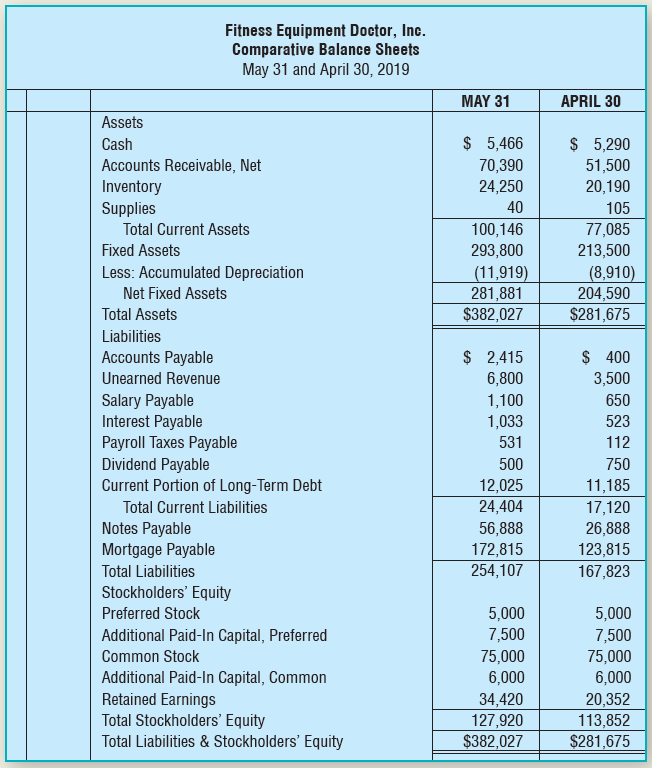

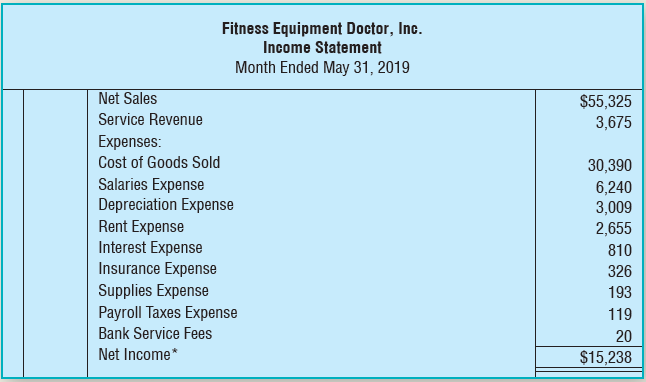

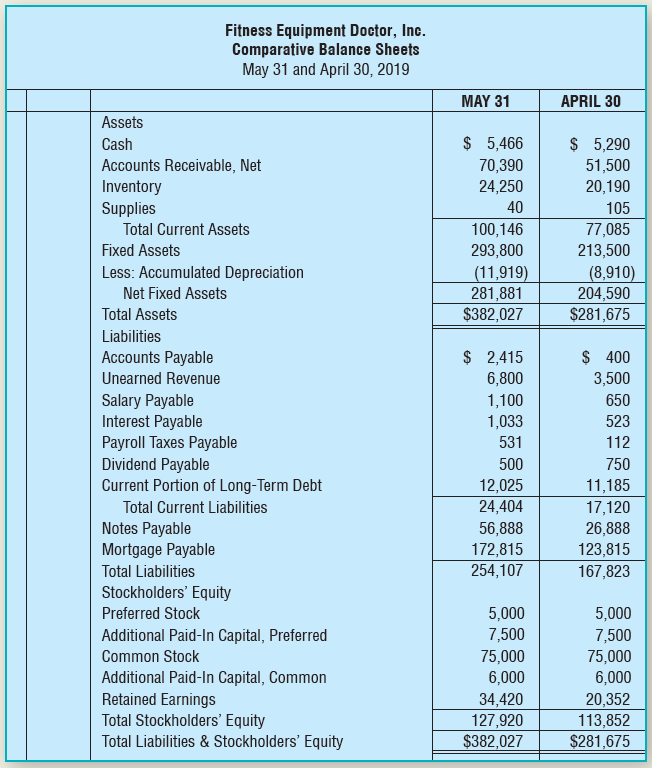

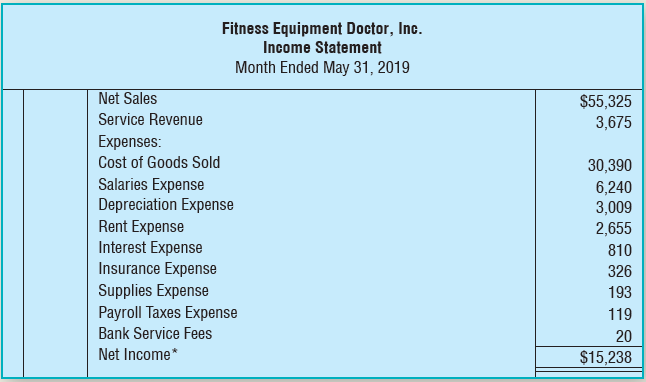

In Chapter 11, we prepared a cash flow statement for Fitness Equipment Doctor, Inc. Now, we will analyze Fitness Equipment Doctor, Inc.?s financial statements using the tools we learned in this chapter. Following are Fitness Equipment Doctor, Inc.?s balance sheets for the months ended May 31 and April 30, 2019, and the income statement for the month ended May 31, 2019.

Requirements

1. Prepare a vertical analysis of the income statement using a multi-step income statement. Round percentages to one-tenth of a percent.

2. Calculate the current ratio for Fitness Equipment Doctor, Inc., at May 31, 2019.

3. Calculate the quick ratio for Fitness Equipment Doctor, Inc., at May 31, 2019.

4. Why do you think the current and quick ratios are favorable? Do you believe this is a temporary situation or a long-term situation?

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

Fitness Equipment Doctor, Inc. Comparative Balance Sheets May 31 and April 30, 2019 APRIL 30 MAY 31 Assets $ 5,466 $ 5,290 Cash Accounts Receivable, Net 70,390 24,250 51,500 20,190 Inventory Supplies 40 105 77,085 213,500 Total Current Assets 100,146 293,800 Fixed Assets (11,919) 281,881 $382,027 (8,910) 204,590 $281,675 Less: Accumulated Depreciation Net Fixed Assets Total Assets Liabilities $ 2,415 6,800 $ 400 3,500 Accounts Payable Unearned Revenue Salary Payable Interest Payable Payroll Taxes Payable Dividend Payable Current Portion of Long-Term Debt 1,100 1,033 650 523 531 112 750 500 12,025 24,404 56,888 11,185 Total Current Liabilities 17,120 26,888 123,815 Notes Payable Mortgage Payable 172,815 254,107 Total Liabilities 167,823 Stockholders' Equity Preferred Stock 5,000 7,500 5,000 Additional Paid-In Capital, Preferred 7,500 Common Stock 75,000 6,000 75,000 6,000 Additional Paid-In Capital, Common Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity 34,420 127,920 $382,027 20,352 113,852 $281,675 Fitness Equipment Doctor, Inc. Income Statement Month Ended May 31, 2019 Net Sales $55,325 3,675 Service Revenue Expenses: Cost of Goods Sold 30,390 Salaries Expense Depreciation Expense Rent Expense Interest Expense Insurance Expense 6,240 3,009 2,655 810 326 Supplies Expense Payroll Taxes Expense 193 119 Bank Service Fees 20 Net Income* $15,238