In this problem, we continue the accounting for Fitness Equipment Doctor, Inc., from Chapter 3. On June

Question:

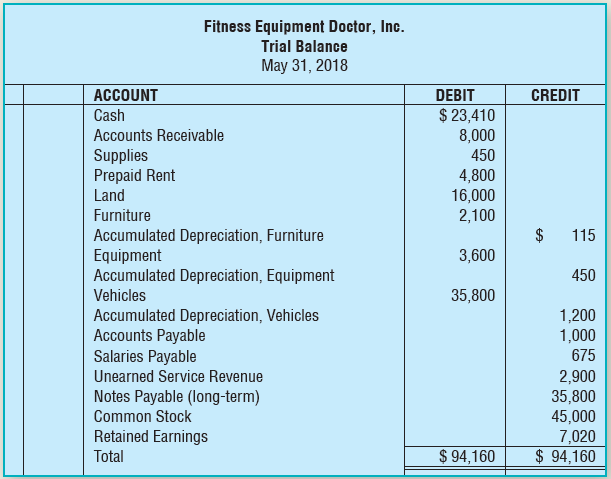

In this problem, we continue the accounting for Fitness Equipment Doctor, Inc., from Chapter 3. On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling and installing gym equipment. The post-closing trial balance for Fitness Equipment Doctor, Inc., as of May 31, 2018, is presented next.

The following transactions occurred during the month of June:

Jun 2 Paid the receptionist?s salary, which was accrued on May 31.3 Purchased $16,500 of merchandise on account from A to Z Equipment, Inc. Terms, 2/15, n/30, FOB shipping point.4 Received $5,800 payment from credit customers for May purchases.5 Purchased $225 of supplies. Paid cash.6 Paid freight charges of $275 related to the June 3 purchase.8 Sold a treadmill for $4,200 (cost, $2,300) on account to B. Sandoval. Terms, 1/15, n/30, FOB shipping point.10 Purchased office furniture for $1,600. Paid cash.11 Paid advertising expense, $565.12 Returned defective gym equipment, which was purchased on June 3. Received a $1,900 credit from A to Z Equipment, Inc.13 Sold gym equipment for $6,800 (cost, $3,700) to a cash customer.14 Provided repair services to cash customers, $865.15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill.16 Paid receptionist?s salary, $675.17 Paid A to Z Equipment, Inc the amount due from the June 3 purchase in full.19 Purchased $13,400 of inventory on account from Fitness Machines, Inc. Terms, 2/10, n/30, FOB destination.21 Sold gym equipment for $9,500 (cost, $5,250) on account to Body in Motion, Inc. Terms, 3/10, n/30, FOB destination.22 Received payment in full from B. Sandoval for the June 8 sale.24 Paid freight charges of $435 to have the gym equipment sold to Body in Motion, Inc. on June 21 delivered.25 Purchased repair equipment on account from Equipment Masters, Inc., for $3,660. Terms, n/30, FOB destination.27 Received payment in full from Body in Motion, Inc. for the June 21 sale.28 Paid in full the invoice from the June 19 purchase from Fitness Machines, Inc.30 Paid monthly utilities, $385.30 Paid sales commissions of $1,760 to the sales staff.

Requirements

1. Journalize the transactions that occurred in June using the ?net? method.

2. Using the four-column accounts from the Continuing Problem in Chapter 3, post the transactions to the ledger, creating new ledger accounts as necessary; omit posting references. Calculate the new account balances.

3. Prepare the unadjusted trial balance for Fitness Equipment Doctor, Inc., at June 30.

4. Journalize and post the adjusting entries for June based on the following adjustment information. Create new ledger accounts as necessary.

a. Record the expired rent.

b. Supplies on hand, $285.

c. Depreciation: equipment, $215; furniture, $65; vehicles, $460.

d. A physical count of inventory revealed $16,295 of inventory on hand.

e. Unearned service revenue still unearned as of June 30 was $275.

f. Accrued the receptionist salary of $675.

g. Record the estimated refund liability for June. The refund liability for the month was estimated to be 5 percent of the gross sales for the month. The cost of goods estimated to be returned was $560.

5. Prepare an adjusted trial balance for Fitness Equipment Doctor, Inc., at June 30.

6. Prepare the multistep income statement and statement of retained earnings for the month ended June 30. Also, prepare a classified balance sheet at June 30. Assume rent expense, salaries expense, depreciation expense, supplies expense, and utilities expense are general expenses.

7. Prepare and post-closing entries.

8. Prepare a post-closing trial balance at June 30.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: