Innovator Ltd incurred expenditure researching and developing a cure for a common disease found in turnips. At

Question:

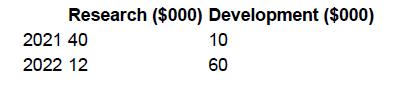

Innovator Ltd incurred expenditure researching and developing a cure for a common disease found in turnips. At the end of 2021, management determined that the research and development project was unlikely to succeed because trials of the prototype had been unsuccessful. During 2022 a breakthrough in agricultural science improved chances of the product succeeding and development resumed. The project was completed in 2022. At the end of 2022 costs incurred on the project were expected to be recoverable. Innovator expects that 10 per cent of the project revenue will be received in 2023, 20 per cent in 2024, 30 percent in 2025, 30 per cent in 2026 and 10 per cent in 2027. After five years the product will be at the end of its useful life because the disease found in turnips will have been eradicated. Costs incurred were as follows:

REQUIRED

a. How much research expenditure and development expenditure should be recognised as an expense in 2021?

b. How much research and development expenditure should be recognised as an expense in 2022?

c. State how much expenditure should be carried forward (deferred) and reported in the statement of financial position at the end of 2021 and 2022.

d. Prepare journal entries for the amortisation of deferred costs in 2023 and 2024, assuming that actual revenues are as expected. State the amount of deferred expenditure carried forward in the statement of financial position in relation to the deferred costs.

e. Assume that after charging amortisation based on sales revenue at the end of 2022 the discounted net cash flows expected to be generated from the deferred expenditure were estimated as $15 000. Prepare any journal entries required to account for this information.

Step by Step Answer: