It is December 2018, and Rob Blandig, the CEO of Carmich Industries, has decided to sell the

Question:

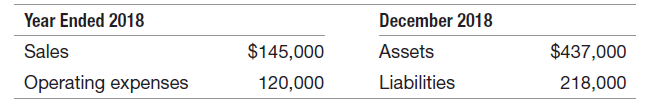

a. Prepare the 2018 income statement, beginning with net income from continuing operations, assuming that Rob accepts the offer, and explain how a user might interpret the items on the income statement in terms of earnings persistence.

a. Prepare the 2018 income statement, beginning with net income from continuing operations, assuming that Rob accepts the offer, and explain how a user might interpret the items on the income statement in terms of earnings persistence.b. Prepare the 2018 income statement, beginning with net income from continuing operations, assuming that Rob chooses not to sell the division in 2018, and explain how a user might interpret the items on the income statement in terms of earnings persistence.

c. Describe some of the important trade-offs Rob faces as he decides whether to complete the sale in 2018 or 2019.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: