Jason Vu offers tutoring services to first-year university students. He has set up a sole proprietorship business

Question:

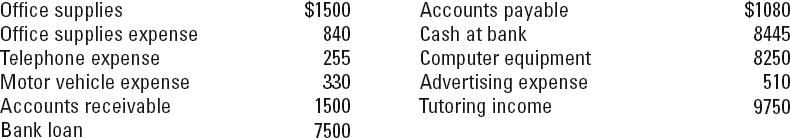

Jason Vu offers tutoring services to first-year university students. He has set up a sole proprietorship business named JV Tutoring. Jason has collected the following information relating to his business activities at the end of the financial year:

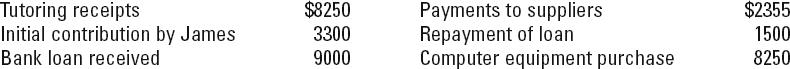

The following information was disclosed from examining Jason’s bank statement:

Required

A. Without preparing formal financial statements, calculate the following:

1. Profit/loss for the year

2. Total assets at the end of the year

3. Total liabilities at the end of the year

4. Jason Vu’s capital balance at the end of the year

5. Net cash inflow/outflow for the year.

B. Recalculate the figures you provided in requirement A, assuming that Jason had withdrawn $5000 in cash during the year.

C. Jason cannot deal with the demand for tutoring services. Simon, Jason’s friend, is prepared to make a capital contribution and join the business as an owner. Advise Jason on the advantages and disadvantages of establishing the business as a partnership or company.

Step by Step Answer:

Financial Accounting

ISBN: 9781118608203

9th Edition

Authors: John Hoggett, Lew Edwards, John Medlin, Keryn Chalmers, Jodie Maxfield, Andreas Hellmann, Claire Beattie