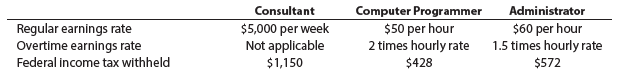

K. Mello Company has three employeesa consultant, a computer programmer, and an administrator. The following payroll information

Question:

For hourly employees, overtime is paid for hours worked in excess of 40 hours per week.

For the current pay period, the computer programmer worked 48 hours and the administrator worked 51 hours. Assume that the social security tax rate was 6.0%, and the Medicare tax rate was 1.5%. Determine the gross pay and the net pay for each of the three employees for the current pay period.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Financial Accounting

ISBN: 9781337398169

15th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

Question Posted: