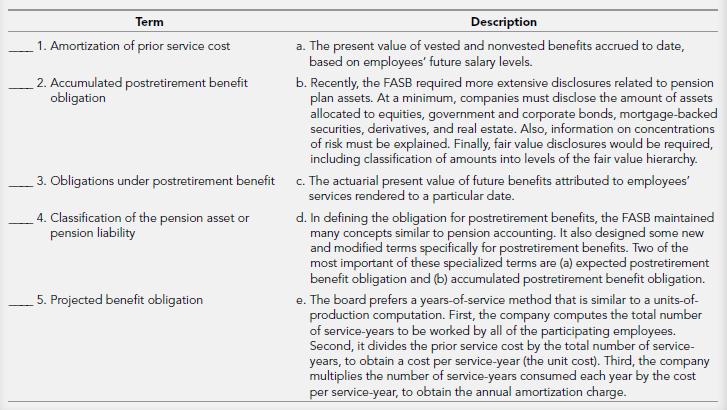

Match the following pension and postretirement benefit terms and descriptions. Term 1. Amortization of prior service cost

Question:

Match the following pension and postretirement benefit terms and descriptions.

Transcribed Image Text:

Term 1. Amortization of prior service cost 2. Accumulated postretirement benefit obligation 3. Obligations under postretirement benefit 4. Classification of the pension asset or pension liability 5. Projected benefit obligation Description a. The present value of vested and nonvested benefits accrued to date, based on employees' future salary levels. b. Recently, the FASB required more extensive disclosures related to pension plan assets. At a minimum, companies must disclose the amount of assets allocated to equities, government and corporate bonds, mortgage-backed securities, derivatives, and real estate. Also, information on concentrations of risk must be explained. Finally, fair value disclosures would be required, including classification of amounts into levels of the fair value hierarchy. c. The actuarial present value of future benefits attributed to employees' services rendered to a particular date. d. In defining the obligation for postretirement benefits, the FASB maintained many concepts similar to pension accounting. It also designed some new and modified terms specifically for postretirement benefits. Two of the most important of these specialized terms are (a) expected postretirement benefit obligation and (b) accumulated postretirement benefit obligation. e. The board prefers a years-of-service method that is similar to a units-of- production computation. First, the company computes the total number of service-years to be worked by all of the participating employees. Second, it divides the prior service cost by the total number of service- years, to obtain a cost per service-year (the unit cost). Third, the company multiplies the number of service-years consumed each year by the cost per service-year, to obtain the annual amortization charge.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

1 e 2...View the full answer

Answered By

Rehab Rahim

I am well versed in communicating and teaching in areas of all business subjects. I have helped many students in different ways from answering answers to writing their academic papers.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Financial Accounting Theory And Analysis Text And Cases

ISBN: 9781119577775

13th Edition

Authors: Richard G Schroeder, Myrtle W Clark, Jack M Cathey

Question Posted:

Students also viewed these Business questions

-

The 2013 financial statements of Lexmark International, Inc., a leading developer, manufacturer, and sup-plier of printing, imaging, and device management, indicated that it reported an accounting...

-

Operating cash flow. Find the operating cash flow for the year for Harper Brothers, Inc. if it had sales revenue of $319,200,000, cost of goods sold of $130,200,000, sales and administrative costs of...

-

The following questions are used in the Kaplan CPA Review Course to study pensions and other postretirement benefits while preparing for the CPA examination. Determine the response that best...

-

At December 31, 2016, Pioneer Corporation reported the stockholders' equity accounts shown here (with dollar amounts in millions, except per-share amounts). Common stock $3.00 par value per share, 22...

-

A drug manufacturer is considering how many of four new drugs to develop. Suppose it takes one year and $10 million to develop a new drug, with the entire cost being paid up front (immediately). The...

-

What is a scheduled receipt? From where does it originate?

-

Select three firms in an industry such as pharmaceuticals or homebuilding and compare the following ratios for the three firms: current ratio, debt ratio, return on assets, return on equity, and net...

-

The Gallup Organization regularly surveys adult Americans regarding their commute time to work. In addition, they administer a Well-Being Survey. According to the Gallup Organization, The...

-

Freddy runs a business selling clocks. He buys 905 clocks for $44 each (including GST) and sells for $77 each (inc GST). He is registered for GST credits. How much should he remit to the ATO once all...

-

Image Maker Company enters into a lease of nonspecialized digital imaging equipment with Agee Equipment Inc on January 1, 2020. Image Maker Company is a manufacturer of digital imaging equipment that...

-

On January 1, Majewski Company enters into an arrangement to obtain the right to access land owned by Burgess Inc. for 40 years. The land is located in Wisconsin and is used by Burgess Inc. to grow...

-

What opportunities do you see for extending hospitality services to the elderly? What facilities are available in your community for independent living for the aging? LO1

-

Nequired information Exercise 5-17 (Static) Notes receivable-interest accrual and collection LO 5-6 (The following information applies to the questions displayed below) Agrico Incorporated accepted...

-

Case 14-3 Sarin Pharmaceuticals Ltd. Alan Mannik, director of procurement for the Sarin Phar- maceuticals Ltd. (Sarin) Animal Health Division plant in Vancouver, British Columbia, was planning for...

-

CL727 LEGAL ANALYSIS AND WRITING Module 11 Assignment: Brief Answer, Analysis, and Conclusion This assignment will be due in Module 11. Your assignment is to write the Brief Answer, Analysis, and...

-

Question 11 (0.5 points) l) Listen } As a drug manufacturer, you expect your latest wonder drug to lower cholesterol. It has been successful with a limited group of participants so far, so you have...

-

Redfern Audio produces audio equipment including headphones. At the Campus Facility, it produces two wireless models, Standard and Enhanced, which differ both in the materials and components used and...

-

Determine the tax liability, marginal tax rate, and average tax rate (rounded to two decimal places) in each of the following cases. Use the Form 1040EZ Tax Tables to determine tax liability. a....

-

How much more interest will be earned if $5000 is invested for 6 years at 7% compounded continuously, instead of at 7% compounded quarterly?

-

What is the nature of? (a) A credit memo issued by the seller of merchandise, (b) A debit memo issued by the buyer of merchandise?

-

What is the nature of? (a) A credit memo issued by the seller of merchandise, (b) A debit memo issued by the buyer of merchandise?

-

Journalize the following merchandise transactions: a. Sold merchandise on account, $41,000 with terms 1/10, n/30. The cost of the merchandise sold was $22,500. b. Received payment less the discount.

-

En prenant un exemple de votre choix, montrer comment on value un swap de taux de change.

-

How much would you need to invest today in order to receive: a. $10,000 in 5 years at 11%? b. $11,000 in 12 years at 8%? c. $12,000 each year for 10 years at 8%? d. $12,000 at the beginning of each...

-

A company that manufactures pulse Doppler insertion flow meters uses the Straight Line method for book depreciation purposes. Newly acquired equipment has a first cost of $190,000 with a 3-year life...

Study smarter with the SolutionInn App