On 1 July 2022 Stokes Ltd acquires 25 per cent of the issued capital of Cotter Ltd

Question:

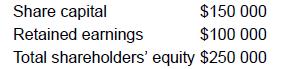

On 1 July 2022 Stokes Ltd acquires 25 per cent of the issued capital of Cotter Ltd for a cash consideration of $120 000. At the date of acquisition, the shareholders’ equity of Cotter Ltd is:

Additional information

- On the date of acquisition, the buildings have a carrying amount in the accounts of Cotter Ltd of $80000 and a fair value of $100 000. The buildings have an estimated useful life of 10 years after 1 July 2022.

- For the year ending 30 June 2023 Cotter Ltd records an after-tax profit of $30 000, from which it pays a dividend of $10 000.

- For the year ending 30 June 2024 Cotter Ltd records an after-tax profit of $100 000, from which it pays a dividend of $50 000.

- Stokes Ltd has a number of subsidiaries.

- The tax rate equals 30 per cent.

REQUIRED

Calculate the amount of goodwill at the date of acquisition, and prepare the journal entries for the years ending 30 June 2023 and 30 June 2024, applying the equity method of accounting.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: