On March 31, 20x1, Robert Electronics Company purchased 4,000 shares of Pat Company for $250,000. The following

Question:

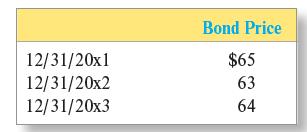

On March 31, 20x1, Robert Electronics Company purchased 4,000 shares of Pat Company for $250,000. The following information applies to the stock of Pat Company:

Pat Company declares cash dividends of $2 per share on November 1 of each year and pays dividends on December 1 of each year.

Required:

1. Prepare journal entries to record the facts in the case, assuming that Robert purchased the shares as a passive investment.

2. Prepare journal entries to record the facts in the case, assuming that Robert used the equity method to account for the investment. Robert owns 40 percent of Pat Company and Pat Company reported $120,000 in income each year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge

Question Posted: