Osborne Organic Foods, Inc., has the following information for the years ending December 31, 2018, and December

Question:

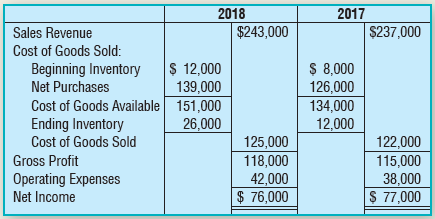

Osborne Organic Foods, Inc., has the following information for the years ending December 31, 2018, and December 31, 2017:

Requirements

1. Compute the rate of inventory turnover for Osborne Organic Foods, Inc., for the years ended December 31, 2018, and December 31, 2017. Round the result to two decimal places.

2. Compute the days-sales-in-inventory for Osborne Organic Foods, Inc., for the years ended December 31, 2018, and December 31, 2017.

3. What is a likely cause for the change in the rate of inventory turnover from 2017 to 2018?

2018 2017 $237,000 $243,000 Sales Revenue Cost of Goods Sold: $ 12,000 139,000 Cost of Goods Available 151,000 26,000 $ 8,000 126,000 134,000 12,000 Beginning Inventory Net Purchases Ending Inventory Cost of Goods Sold 125,000 118,000 42,000 $ 76,000 122,000 115,000 38,000 $ 77,000 Gross Profit Operating Expenses Net Income

Step by Step Answer:

Req 1 2018 Inventory Turnover Cost of Goods Sold 125000 65...View the full answer

Related Video

Inventory turnover is a key metric that helps businesses evaluate the efficiency of their operations. A high turnover ratio is generally considered positive, indicating that the company is effectively selling its inventory and making efficient use of its resources. On the other hand, a low turnover ratio may indicate issues such as overstocking or slow sales and may require further examination to identify and address the underlying causes. Businesses use this ratio to make decisions about inventory levels, production schedules, and pricing strategies. It also helps businesses to identify areas where they may need to make improvements, such as reducing lead times for production or optimizing sales and marketing efforts. Additionally, inventory turnover is used by investors and analysts as a key performance indicator to evaluate the financial health and growth potential of a company.

Students also viewed these Business questions

-

Motion Auto has the following information for the years ending December 31, 2014 and 2013: Requirements 1. Compute the rate of inventory turnover for Motion Auto for the years ended December 31, 2014...

-

Hulus Hybrids has the following information for the years ending January 31, 2014 and 2013: Requirements 1. Compute the rate of inventory turnover for Hulus Hybrids for the years ended January 31,...

-

Sanchez Wholesale, Inc., has the following information for the years ending May 31, 2012 and 2011: Requirements 1. Compute the rate of inventory turnover for Sanchez Wholesale, Inc., for the years...

-

What is the result of the following? A. [Natural History, Science] B. [Natural History, Science, Art] C. The code does not compile. D. The code compiles but throws an exception at runtime. } import...

-

a) Show that 2340 1 (mod 11) by Fermat's little theorem and noting that 2340 = (210)34. b) Show that 2340 1 (mod 31) using the fact that 2340 = (25)68 = 3268. c) Conclude from parts (a) and (b)...

-

What decision-making problems can prevent employees from translating their learning into accurate decisions? LO2

-

Return to the assumption that the company hail S3 million in assets at the end of 2002, but now assume that the company pays no dividends. Under these assumptions, what would be the additional funds...

-

If the General Fund of a certain city needs $6,720,000 of revenue from property taxes to finance estimated expenditures of the next fiscal year and historical experience indicates that 4 percent of...

-

UNLESS OTHERWISE DIRECTED, ASSUME A 2020 TAX YEAR FOR THE PROBLEM. 10. During the current tax year, Glenn and Christine (married filing jointly) have an AGI of $413,000. They also have four children...

-

Jason Kidwell is considering whether or not to acquire a local toy manufacturing company, Toys'n Things Inc. The company's annual income statements for the last three years are as follows: A. Jason...

-

Lets resume our examination of Dicks Sporting Goods (Dicks). Return to Dicks Annual Report (see the Continuing Financial Statement Analysis Problem in Chapter 2 for instructions on how to access the...

-

Sundance Marine Supply, Inc., lost its entire inventory in a hurricane that occurred on March 31, 2018. Over the past five years, gross profit has averaged 35 percent of net sales. The companys...

-

Determine whether the following items are monetary or nonmonetary items. 1. Common stock. 2. Retained earnings. 3. Merchandise. 4. Prepaid rent. 5. Prepaid insurance. 6. Salaries payable. 7....

-

In each of the following cases, (a) identify the aspect of the accounting environment primarily responsible for the ethical pressure on the accountant as pressure to achieve a favorable outcome, to...

-

What is the IRR for an investment of \($1,000\) that yields \($1,300\) in one year?

-

Transit Shuttle Inc. is considering investing in two new vans that are expected to generate combined cash inflows of \($20,000\) per year. The vans combined purchase price is \($65,000\). The...

-

Ginger Smalley expects to receive a \($300,000\) cash benefit when she retires five years from today. Ms. Smalleys employer has offered an early retirement incentive by agreeing to pay her...

-

Travis Vintor is seeking part-time employment while he attends school. He is considering purchasing technical equipment that will enable him to start a small training services company that will offer...

-

Create a factual scenario where property is mislaid.

-

Identify the source of funds within Micro Credit? How does this differ from traditional sources of financing? What internal and external governance mechanisms are in place in Micro Credit?

-

Hobart Parts, Inc., needs new manufacturing equipment. Two companies can provide similar equipment but under different payment plans: a. Tanner Manufacturing offers to let Hobart Parts, Inc., pay...

-

Keiras Sports uses the FIFO inventory method. Keiras Sports started December with 9 helmets that cost $56 each. On December 19, Keiras Sports bought 16 helmets at $51 each. On December 28, Keiras...

-

Keiras Sports uses the LIFO inventory method. Keiras Sports started December with 9 helmets that cost $56 each. On December 19, Keiras Sports bought 16 helmets at $51 each. On December 28, Keiras...

-

can someone show the work to this question Roger has a levered cost of equity of 0.18. He is thinking of investing in a project with upfront costs of $8 million, which pays $1 million per year for...

-

1.9 Alexis Inc. is an under levered public company, with two classes of shares. Since the insiders (who run the company) own the voting shares, the company has the luxury of increasing its debt ratio...

-

for the following cash flows, determine the net present value: $11,923,327 Initial Investment Requirement $953,867 Year One Net Income $1,049,254 Year Two Net Income $1,133,194 Year Three Net Income...

Study smarter with the SolutionInn App