Pugliese Whole Foods, Inc., has the following information for the years ending December 31, 2018, and December

Question:

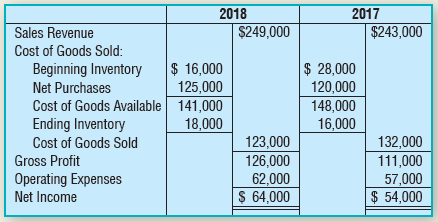

Pugliese Whole Foods, Inc., has the following information for the years ending December 31, 2018, and December 31, 2017:

Requirements

1. Compute the rate of inventory turnover for Pugliese Whole Foods, Inc., for the years ended December 31, 2018, and December 31, 2017. Round the result to two decimal places.

2. Compute the days-sales-in-inventory for Pugliese Whole Foods, Inc., for the years ended December 31, 2018, and December 31, 2017.

3. What is a likely cause for the change in the rate of inventory turnover from 2017 to 2018?

2017 $243,000 2018 Sales Revenue $249,000 Cost of Goods Sold: $ 16,000 125,000 141,000 18,000 $ 28,000 120,000 148,000 16,000 Beginning Inventory Net Purchases Cost of Goods Available Ending Inventory 123,000 126,000 62,000 $ 64,000 132,000 Cost of Goods Sold Gross Profit 111,000 Operating Expenses Net Income 57,000 $ 54,000

Step by Step Answer:

Req 1 2018 Inventory Turnover Cost of Goods Sold 123000 724 times per year Average Inventory 16000 ...View the full answer

Related Video

Inventory turnover is a key metric that helps businesses evaluate the efficiency of their operations. A high turnover ratio is generally considered positive, indicating that the company is effectively selling its inventory and making efficient use of its resources. On the other hand, a low turnover ratio may indicate issues such as overstocking or slow sales and may require further examination to identify and address the underlying causes. Businesses use this ratio to make decisions about inventory levels, production schedules, and pricing strategies. It also helps businesses to identify areas where they may need to make improvements, such as reducing lead times for production or optimizing sales and marketing efforts. Additionally, inventory turnover is used by investors and analysts as a key performance indicator to evaluate the financial health and growth potential of a company.

Students also viewed these Business questions

-

Motion Auto has the following information for the years ending December 31, 2014 and 2013: Requirements 1. Compute the rate of inventory turnover for Motion Auto for the years ended December 31, 2014...

-

Hulus Hybrids has the following information for the years ending January 31, 2014 and 2013: Requirements 1. Compute the rate of inventory turnover for Hulus Hybrids for the years ended January 31,...

-

Sanchez Wholesale, Inc., has the following information for the years ending May 31, 2012 and 2011: Requirements 1. Compute the rate of inventory turnover for Sanchez Wholesale, Inc., for the years...

-

How many objects are eligible for garbage collection at the end of the main() method? A. None. B. One. C. Two. D. Three. E. The code does not compile. F. None of the above. package store; public...

-

Let m1, m2, . . . , mn be pairwise relatively prime integers greater than or equal to 2. Show that if a b (mod mi) for i = 1, 2, . . . , n, then a b (mod m), where m = m1m2 mn. (This result will...

-

Class discussion (whether in groups or as a class) should centre on whether the theft thats occurring at The Grocery Cart reveals a problem of moral awareness, moral judgment, or moral intent. LO8

-

Define each of the following terms: a. Mission statement b. Sales forecast c. Percent of sales method d. Spontaneously generated funds e. Pro forma financial statement f. Additional funds needed...

-

The Garcia-Lanoue Company produces industrial goods. The company receives purchase orders from its customers and ships goods accordingly. Assuming that the following conditions apply, develop a...

-

LIFO retail inventory method, fluctuating prices. Flint Department Store wishes to use the retail LIFO method of valuing inventories for 2021. The appropriate data are as follows: At Cost At Retail...

-

Rick Sanford lives in a small community in northern Minnesota. He is planning to open the only fried chicken restaurant in his area and would like to trademark the words fried chicken. Because of his...

-

Titan Truck Parts, Inc., uses the LIFO inventory method and values its inventory using the lower-of-cost-or-market (LCM) rule. Titan Truck Parts, Inc., has the following account balances at December...

-

Gallinger Enterprises, Inc., lost its entire inventory in a hurricane that occurred on May 31, 2018. Over the past five years, gross profit has averaged 38 percent of net sales. The companys records...

-

Verify that the Airy stress function: e solves the problem of a cantilever beam loaded by uniform shear along its bottom edge as shown. Use pointwise boundary conditions on y = tc and only resultant...

-

Keep-on-Truckin Corporation (KOTC) is a manufacturer and distributor of shoes. It has established electronic data interchange (EDI) links with most of its customers. The sequence of electronic...

-

I think the waiter wrote in an extra \($25\) tip on my Sunshine Caf bill after I received and signed my credit card receipt, Mark Otter said to the restaurant manager, Brad Gladiolus. Mr. Otter, mail...

-

The following transactions occurred during January, the first month of operations for Red Corporation. Prepare journal entries and create a T-account for inventory that includes the following five...

-

Make T-accounts for the following accounts that appear in the general ledger of The Canine Hospital, owned by Kali Wells, a veterinarian: Cash; Accounts Receivable; Supplies; Office Equipment;...

-

On January 12, 2010, a major earthquake hit Haiti and the Dominican Republic. The epicenter of the quake was 25 kilometers southwest of the Haitian capital of Port-au-Prince and only 13 kilometers...

-

Alejo Lopez was a married man. Without divorcing, he married a second time. He and his second wife, Helen, purchased property and tried to take title as tenants by the entireties. Later Alejo...

-

After graduating from college and working a few years at a small technology firm. Preet scored a high-level job in the logistics department at Amex Corporation. Amex sells high-quality electronic...

-

Refer to the data for E5-16A. However, instead of the FIFO method, assume Jamesons Sports Shop uses the average cost method. Requirements 1. Prepare a perpetual inventory record for the watches on...

-

Assume that Western Sporting Goods bought and sold a line of mountain bikes during May as follows: Western Sporting Goods uses the perpetual inventory system. Requirements 1. Compute the cost of...

-

Refer to the data for Western Sporting Goods in E5-19A. Requirements 1. Compute the cost of goods sold under FIFO. 2. Compute the cost of goods sold under LIFO. 3. Which method results in the higher...

-

What if a contract requires a specific airline for shopping goods, and that airline goes bankrupt before goods were shipped?

-

Based on the npv rule, you should invest in a project with an npv of -1,254. True or false

-

Retail giant, BAM Incorporated, sells 5,000 hammers annually. Each hammer costs BAM $5 purchase. Inventory carrying costs are 10% (.10) of the purchase price and the cost of placing an order with its...

Study smarter with the SolutionInn App