RDP and Brothers purchased a panel truck for $25,000 on January 1, 2017. It estimated the life

Question:

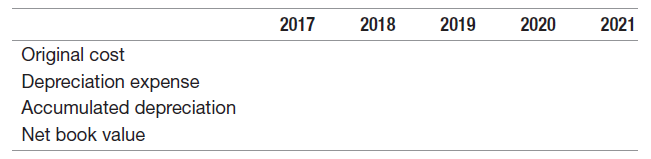

a. In line with generally accepted accounting principles, determine the amounts required here.

b. Why did you decide to initially recognize the cost as an asset rather than treat it as an expense? What basic assumption of financial accounting are you relying upon in this decision?

c. Why did you allocate a portion of the cost to each of the five years? What basic principle of financial accounting measurement are you relying upon in this decision?

2017 2018 2019 2021 2020 Original cost Depreciation expense Accumulated depreciation Net book value

Step by Step Answer:

a b Since the truck has an estimated useful life of five years it is assumed that RDP and Brothers w...View the full answer

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Analyzing a Students Business and Preparing an Income Statement Upon graduation from high school, Sam List immediately accepted a job as an electricians assistant for a large local electrical repair...

-

Upon graduation from high school, John Abel immediately accepted a job as an electrician's assistant for a large local electrical repair company. After three years of hard work, John received an...

-

Upon graduation from high school, Sam List immediately accepted a job as an electrician's assistant for a large local electrical repair company. After three years of hard work, Sam received an...

-

Consider a stylized two-period model with banking. The aggregate abatement cost function in period t is given by C(E)= (a t be) 2 /2b with a 1 < a 2 is D(E)=dE 2 /2. (a) Determine the optimal...

-

In Freedonia and Prisonia there are no taxes, and the capital markets are well-integrated across the two countries. Two multinational utility firms, FreeCorp and PriCorp, have WOSs that compete in...

-

The period of vibration of the system of three springs and a block is observed to be 0.2s. After the lower spring of constant k2 = 16kN/m is removed from the system the period is observed to be...

-

E19-12 CoverUp manufactures and sells a new line of sun-protection clothing. Unfortunately. CoverUp suffered serious hurricane damage at its home office in Miami, Florida, As a result, the accounting...

-

A triangle can be formed by drawing line segments on a map of Minnesota connecting the cities of Austin, Rochester, and St. Paul (see figure below). If the actual distance from Austin to Rochester is...

-

3. What's the Revenue (WTR) Company enters into a 6 month contract to provide consulting services related to a customer's computer system. The customer agrees to pay $200 per hour for the services up...

-

KinderKids provides daycare for children Mondays through Fridays. Its monthly variable costs per child are as follows: Lunch and snacks ................. $ 100 Educational supplies ...................

-

The December 31, 2014 balance sheet and the income statement for the period ending December 31 for Manpower Inc., a world leader in staffing and workforce management solutions, follow (dollars in...

-

On January 1, 2017, Barry Smith established a company by contributing $90,000 and using all of the cash to purchase an apartment house. At the time, he estimated that cash inflows due to rentals...

-

Balance Sheet Analysis The balance sheets of Company A and Company B are presented below: You have been asked to evaluate the comparative liquidity and leverage positions of the two companies: a. For...

-

Case Study : While it might be easy to see the negative effects on the environment from car emissions or the waste we produce, fewer people think about the effects of discarded clothes on the...

-

CompanyWeek 8 Assignment - Financial Statement Analysis Overview In this assignment, you will take your work with financial statements to the next level. You will analyze financial statements similar...

-

In Exercises 9-12, assume that 100 births are randomly selected. Use subjective judgment to describe the given number of girls as (a) significantly low, (b) significantly high, or (c) neither...

-

Which of the following is not included in the cash flow statement? a. Cash from short-term investments b. Cash from operations c. Cash from the balance sheet d. Cash from capital financing Which of...

-

Case Study Chapter 13B Pharm - Saved Case Study Chapter 13 Central Nervous System Stimulants and Related Drugs Nancy has been unsuccessful in preventing migraine headaches and has been prescribed a...

-

What do the Regression Index and the Overall Regression Index measure?

-

The packaging division of a company having considered several alternative package designs for the company's new product has finally brought down their choices to two designs of which only one has to...

-

You are currently auditing the financial records of Paxson Corporation, which is located in San Francisco, California. During the current year, inventories with an original cost of $2,325,000 were...

-

The management of Sting Enterprises shares in a bonus that is determined and paid at the end of each year. The amount of the bonus is defined by multiplying net income from continuing operations...

-

The following income statement was reported by battery Builders for the year ending December 31, 2012: Show how battery builders would report earrings per share on the face of the income statement,...

-

What is the present value of $500 invested each year for 10 years at a rate of 5%?

-

GL1203 - Based on Problem 12-6A Golden Company LO P2, P3 Golden Corp.'s current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are...

-

A project with an initial cost of $27,950 is expected to generate cash flows of $6,800, $8,900, $9,200, $8,100, and $7,600 over each of the next five years, respectively. What is the project's...

Study smarter with the SolutionInn App