Refer to the information provided for Lewis and Associates in Problem 4-9A. Data from 4-9A Lewis and

Question:

Data from 4-9A

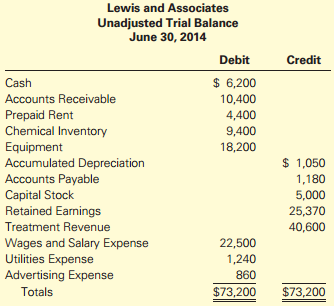

Lewis and Associates has been in the termite inspection and treatment business for five years. An unadjusted trial balance at June 30, 2014, follows.

The following additional information is available:

a. Lewis rents a warehouse with office space and prepays the annual rent of $4,800 on May 1 of each year.

b. The asset account Equipment represents the cost of treatment equipment, which has an estimated useful life of ten years and an estimated salvage value of $200.

c. Chemical inventory on hand equals $1,300.

d. Wages and salaries owed but unpaid to employees at the end of the month amount to $1,080.

e. Lewis accrues income taxes using an estimated tax rate equal to 30% of the income for the month.

Required

Prepare a table to summarize the required adjusting entries as they affect the accounting equation. Use the format in Exhibit 3-1 on page 109. Identify each adjustment by letter.

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Financial Accounting The Impact on Decision Makers

ISBN: 978-1285182964

9th edition

Authors: Gary A. Porter, Curtis L. Norton