Refer to the information provided for Reynolds Realty Company in Problem 4-6. Data from 4-6 Bob Reynolds

Question:

Data from 4-6

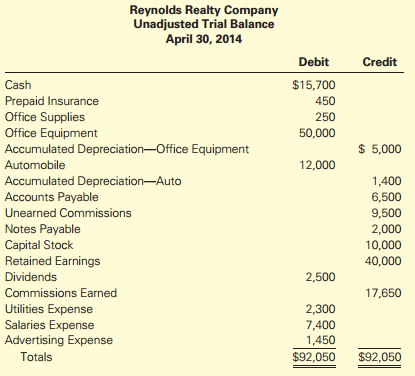

Bob Reynolds operates a real estate business. A trial balance on April 30, 2014,beforeany adjust-ing entries are recorded, appears as follows:

Other Data

a. The monthly insurance cost is $50.

b. Office supplies on hand on April 30, 2014, amount to $180.

c. The office equipment was purchased on April 1, 2013. On that date, it had an estimated useful life of ten years.

d. On September 1, 2013, the automobile was purchased; it had an estimated useful life of five years.

e. A deposit is received in advance of providing any services for first-time customers. Amounts received in advance are recorded initially in the account Unearned Commissions. Based on services provided to these first-time customers, the balance in this account at the end of April should be $5,000.

f. Repeat customers are allowed to pay for services one month after the date of the sale of their property. Services rendered during the month but not yet collected or billed to these customers amount to $1,500.

g. Interest owed on the note payable but not yet paid amounts to $20.

h. Salaries owed but unpaid to employees at the end of the month amount to $2,500.

Required

1. Prepare a table to summarize the required adjusting entries as they affect the accounting equation. Use the format in Exhibit 3-1 on page 109. Identify each adjustment by letter.

2. Compute the net increase or decrease in net income for the month from the recognition of the adjusting entries you prepared in part (1). (Ignore income taxes.)

Step by Step Answer:

Financial Accounting The Impact on Decision Makers

ISBN: 978-1285182964

9th edition

Authors: Gary A. Porter, Curtis L. Norton