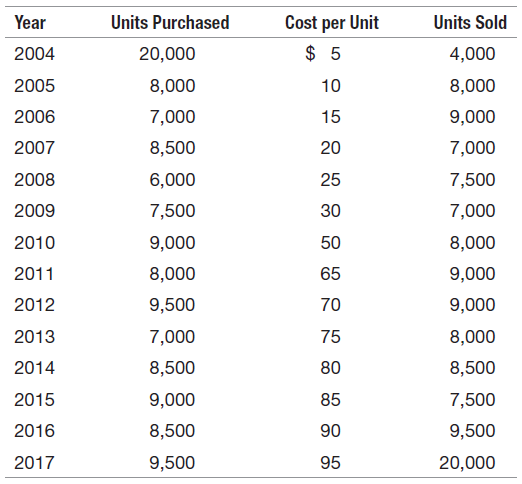

Ruhe Auto Supplies began operations in 2004. The companys inventory purchases and sales in the first and

Question:

The company€™s federal income tax rate is 30 percent and the inventory at December 31, 2016 was $112,500. For the year ended December 31, 2017, Ruhe Auto Supplies generated $3,000,000 in revenues and incurred $800,000 in expenses (exclusive of cost of goods sold). Ruhe Auto Supplies uses the LIFO cost fl ow assumption to account for inventory.

REQUIRED:

a. Compute ending inventory as of December 31, 2017. Identify the number of units in ending inventory and the costs attached to each unit.

b. Compute the company€™s 2017 income tax liability and net income after taxes for the year ended December 31, 2017.

c. Assume that Ruhe Auto Supplies was able to purchase an additional 10,500 units of inventory on

December 31, 2017 for $95 per unit. Would you advise the company to purchase these additional units? Explain your answer.

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer: