Seattle Physicians Group borrowed $300,000 on July 1, 2018, by issuing a 6 percent long-term note payable

Question:

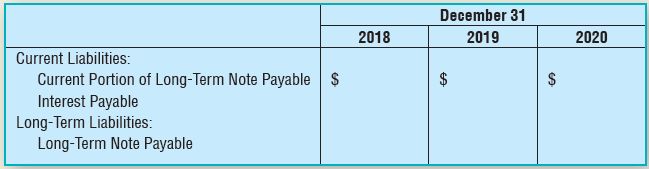

Seattle Physicians Group borrowed $300,000 on July 1, 2018, by issuing a 6 percent long-term note payable that must be paid in three equal annual installments, plus interest, each July 1 for the next three years.

Requirement

Insert the appropriate amounts below to show how Seattle Physicians Group would report its current and long-term liabilities.

Transcribed Image Text:

December 31 2018 2019 2020 Current Liabilities: Current Portion of Long-Term Note Payable Interest Payable Long-Term Liabilities: Long-Term Note Payable $ %24 %24

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 78% (14 reviews)

December 31 2018 2019 2020 Current liabilities Current portion of longter...View the full answer

Answered By

WAHIDUL HAQUE

hello,

I'm a professional academic solution provider working as a freelance academic solution provider since 7 years. I have completed numerous projects. Help lots of students to get good marks in their exams and quizzes. I can provide any type of academic help to your homework, classwork etc, if you are a student of Accounting, Finance, Economics, Statistics. I believe in satisfying client by my work quality, rather than making one-time profit. I charge reasonable so that we make good long term relationship. why will you choose me? i am an extremely passionate, boldly honest, ethically driven and pro-active contractor that holds each of my clients in high regards throughout all my business relations. in addition, I'll always make sure that I'm giving my 100% better in every work that will be entrusted to me to be able to produce an outcome that will meet my client's standards. so if you are a student that is now reading my profile and considering me for your academic help. please feel free to look through my working history, feedback and contact me if you see or read something that interests you. I appreciate your time and consideration.

regards

4.90+

233+ Reviews

368+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Seattle Physicians Group borrowed $300,000 on July 1, 2016, by issuing a 6 percent long-term note payable that must be paid in three equal annual installments plus interest each July 1 for the next...

-

Carruthers Medical Group borrowed $300,000 on July 1, 2014, by issuing a 9% long term note payable that must be paid in three equal annual installments plus interest each July 1 for the next three...

-

Bon Secour Medical Group borrowed $600,000 on July 1, 2014, by issuing a 14% long term note payable that must be paid in three equal annual installments plus interest each July 1 for the next three...

-

A firm has four service centers, S1, S2, S3, and S4, which provide services to each other, as well as to three operating divisions, A, B, and C. The distribution of each service centers output as...

-

Prove that if f (x) is a nonconstant polynomial with integer coefficients, then there is an integer y such that f (y) is composite.

-

Describe disadvantages of the PD@GE app. Explain why managers with longer tenure at GE may have doubts about the effectiveness of the PD@GE app? What could be done to alleviate potential concerns? LO6

-

Identify three problems with the executive incentive compensation packages normally used in U.S. corporations.

-

Moore Farms is a grower of hybrid seed corn for DeKalb Genetics Corporation. It has had two exceptionally good years and has elected to invest its excess funds in bonds. The following selected...

-

Decision on Transfer Pricing Materials used by the Instrument Division of Ziegler Inc. are currently purchased from outside suppliers at a cost of $396 per unit. However, the same materials are...

-

What is the Hamming distance for each of the following codewords? a. d (10000, 00000) b. d (10101, 10000) c. d (00000, 11111) d. d (00000, 00000)

-

At December 31, 2018, Christianson Cabinets owes $5,700 on accounts payable, plus salaries payable of $3,200 and income tax payable of $7,000. Christianson Cabinets also has $280,000 of notes payable...

-

Solar Corp. issued a $460,000, 8 percent mortgage on January 1, 2018, to purchase warehouses. Requirements 1. Complete the amortization schedule for Solar Corp., assuming payments are made...

-

Each species of bacteria has its own distinctive cell surface. The characteristics of the cell surface play an important role in processes such as conjugation and transduction. For example, certain...

-

As the accounting clerk, you are tasked by the CFO to determine the cost of goods sold of Del Mundo Company for the year ended December 31, 2020. During Operating cost data annd inventory account...

-

Using the ideas of kinetic particle theory when you come home from school and open the door you can smell food being cooked

-

The following information relates to Salamat Corporation for the last year.Salamat uses direct labor hours as an overhead base. Estimated direct labor hours 360,000 hours Estimated manufacturing...

-

Code in matlab the translational motion via numeric integration of the orbit (two-body orbit sufficient). Use the orbital characteristics of the Centaur V upper stage from the Atlas V launch on...

-

Lolita Company has the following information available for June 2020: Beginning Work in Process Inventory (25% as to conversion) 20,000 units Started 130,000 units Ending Work in Process Inventory...

-

What changes in the settlors life should cause the updating of a will?

-

What are the four types of poultry production systems? Explain each type.

-

Specify how each of the following items would be reported in the financial statements of Tingsley Enterprises for its current fiscal year. Also specify the amount that would appear on the statement....

-

Pierce Systems purchased land, paying $65,000 cash as a down payment and signing a $260,000 note payable for the balance. In addition, Pierce Systems paid delinquent property tax of $3,500, title...

-

Lopez Transfer manufactures conveyor belts. Early in August 2013, Lopez Transfer constructed its own building at a materials, labor, and overhead cost of $950,000. Lopez Transfer paid cash for the...

-

You have the alternative of paying for gym fees today for a payment of $16,000 or, you can choose a plan where you pay $7,000 in 9 months from today and another $11,000 in 23 months from today. If...

-

You are a financial adviser andapproached by married couple Diane and Leo Alexander.They have limited financial knowledge and are seeking your advice about their current financial status. The...

-

SecuriCorp operates a fleet of armored cars that make scheduled pickups and dellveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity...

Study smarter with the SolutionInn App