Question: Taking the data of Example 9 & 10 and assuming that amalgamation is in the nature of purchase and that after the amalgamation acquirer is

Taking the data of Example 9 & 10 and assuming that amalgamation is in the nature of purchase and that after the amalgamation acquirer is required to maintain statutory reserves, show how these will appear in the books of account of CL and DL.

Data from Example 9

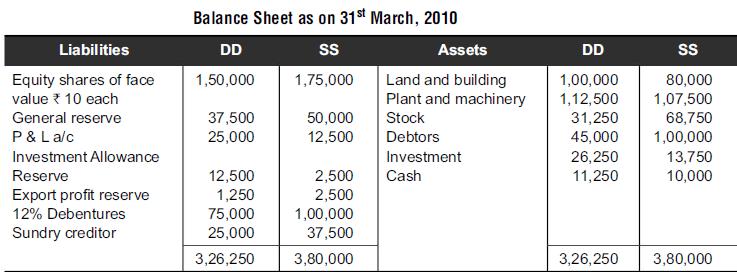

DD Limited and SS Limited amalgamated on 1st April, 2010. All the assets and liabilities of both the companies were acquired by newly established company DS Limited. Following was the balance sheet of both the companies on 1st April, 2010.

DS agreed to issue required number of equity shares of face value ₹10 each to discharge the purchase consideration to both the amalgamating companies. Calculate purchase consideration. Also identify the acquirer if IFRS-03 or Ind-AS-103 is applicable.

Data from Example10

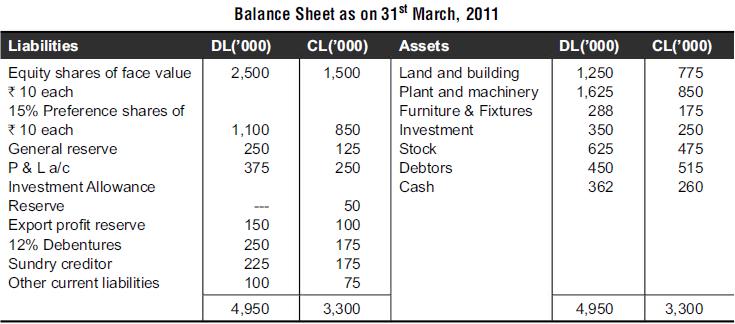

On 1st April, 2011, Dickins Limited (DL) acquired the business of Ceepee Limited (CL) by acquiring all the assets and liabilities at the book value it agreed to discharge the purchase consideration as follows:

(i) To issue 1,75,000 equity shares of face value of ₹10 each to the equity shareholders of CL

ii) To issue requisite number of 10% preference shares of ₹10 at par so as to redeem 15% preference shares of CL at a premium of 10%

Show how purchase consideration will be calculated if it is

(i) amalgamation in the nature of merger and

(ii) amalgamation in the nature of purchase.

Liabilities Equity shares of face value* 10 each General reserve P & La/c Investment Allowance Reserve Export profit reserve 12% Debentures Sundry creditor Balance Sheet as on 31st March, 2010 SS 1,75,000 DD 1,50,000 37,500 25,000 12,500 1,250 75,000 25,000 3,26,250 50,000 12,500 2,500 2,500 1,00,000 37,500 3,80,000 Assets Land and building Plant and machinery Stock Debtors Investment Cash DD 1,00,000 1,12,500 31,250 45,000 26,250 11,250 3,26,250 SS 80,000 1,07,500 68,750 1,00,000 13,750 10,000 3,80,000

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Explanation i The amount of shares issued by DL is less than the amount of net assets value by 190000 2875000 2685000 this difference is to be conside... View full answer

Get step-by-step solutions from verified subject matter experts