The 2014 annual report of Sherwin Williams, a manufacturer of paint products, contained the following footnote (dollars

Question:

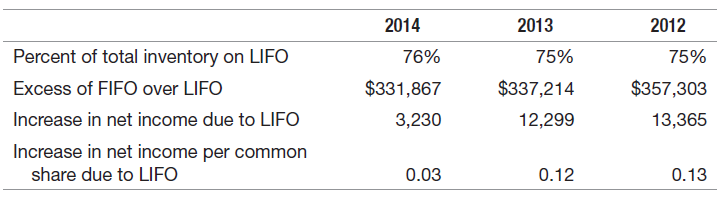

Note 3-Inventories

Inventories were stated at the lower of cost or market with cost determined principally on the last-in, first-out (LIFO) method. The following presents the effect on inventories, net income, and net income per common share had the Company used the first-in, first-out (FIFO) inventory valuation method adjusted for income taxes at the statutory rate and assuming no other adjustments. Management believes that the use of LIFO results in a better matching of costs and revenues. The information is presented to enable the reader to make comparisons with companies using the FIFO method of inventory valuation.

REQUIRED:

a. Sherwin Williams reported inventories on the balance sheet at $1,033,527 (2014), $970,815 (2013), and $920,324 (2012). Compute the company€™s ending inventory had it shifted to FIFO at the end of 2014 (dollars in thousands).

b. Estimate the taxes saved by Sherwin Williams because it uses LIFO instead of FIFO. Assume a tax rate of 33 percent.

c. Does LIFO provide a better matching of current costs to revenues in times of inflation? Why? Is the same true in times of deflation?

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: