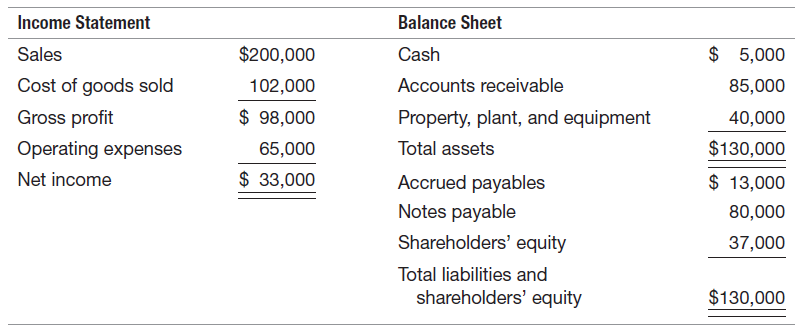

The following financial information represents Hadley Companys first year of operations, 2017: After reading Hadleys financial statements,

Question:

After reading Hadley€™s financial statements, you conclude that the company had a very successful first year of operations. However, after further examination, you note that the sales figure on the income statement was not adjusted for a bad debt expense. You also realize that a large percentage of Hadley€™s sales were to three customers, one of which, Litzenberger Supply, is in very questionable financial health, although still in business. Litzenberger owes Hadley $50,000 as of the end of 2017.

REQUIRED:

a. Adjust the financial statements of Hadley Company to reflect a more conservative reporting with respect to bad debts. That is, establish a provision for the uncollectibility of Litzenberger€™s account. Recompute net income. How does this adjustment affect your assessment of Hadley€™s first year of operations?

b. Why would auditors probably require that Hadley choose the more conservative reporting?

c. Hadley€™s chief financial officer claims that no bad debt expense should be recorded, because Litzenberger is still conducting operations as of the end of 2017. How would you respond to this claim?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: