The following is the balance sheet of Robins Utthappam Ltd. as on 31st March, 2016: All the

Question:

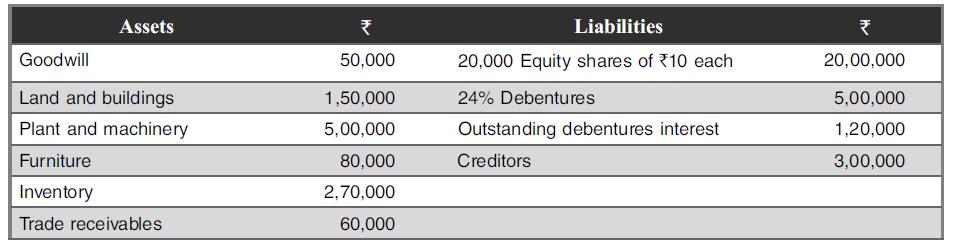

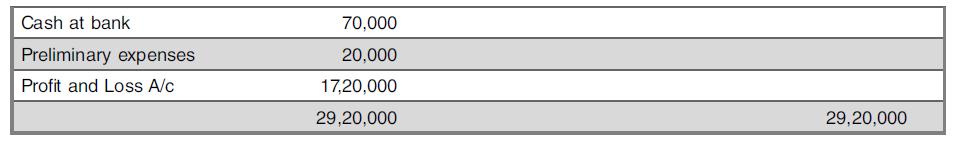

The following is the balance sheet of Robin’s Utthappam Ltd. as on 31st March, 2016:

All the stakeholders meet and it is settled that the company would be worthless being liquidated at that point in time. Thus, each stakeholder foregoes some benefits/claims from their side. The following scheme of reconstruction is executed:

Equity shares are reduced by ₹9 per share.

Debenture holders agree to forego outstanding debenture interest with a belief that it is better to take something back rather than go empty.

Creditors are given the option to either accept 50% of their claim in cash in full settlement or to convert their claim into equity shares of ₹1 each. Creditors for ₹1 lakh opt for shares in satisfaction of their claims.

To make payment to creditors opting for cash payment and to augment working capital, the company issues 8 lakh equity shares of ₹1 each at par, the entire amount being payable along with applications. The issue was fully subscribed by promoters.

Land and buildings are revalued at ₹3 lakh whereas plant and machinery is to be written down to ₹2.5 lakh. A provision amounting to ₹5,000 is to be made for doubtful debts. Pass journal entries and draft the company’s balance sheet immediately after the reconstruction.

Based on the above information on Robin’s Utthappa Ltd., you are required to make adjustments to the balance sheet and prepare the balances again. Based on the same, please fill the following blanks:

(i) The issued and subscribed share capital of the company would be _______________

(ii) The long-term liabilities would be having the following ________________

(iii) The current liabilities and provisions of the company would be ___________

(iv) The fixed assets of the company would be equal to __________________

(v) The bank balance of the company would be ______________________

(vi) The current assets of the company would be _____________________

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani